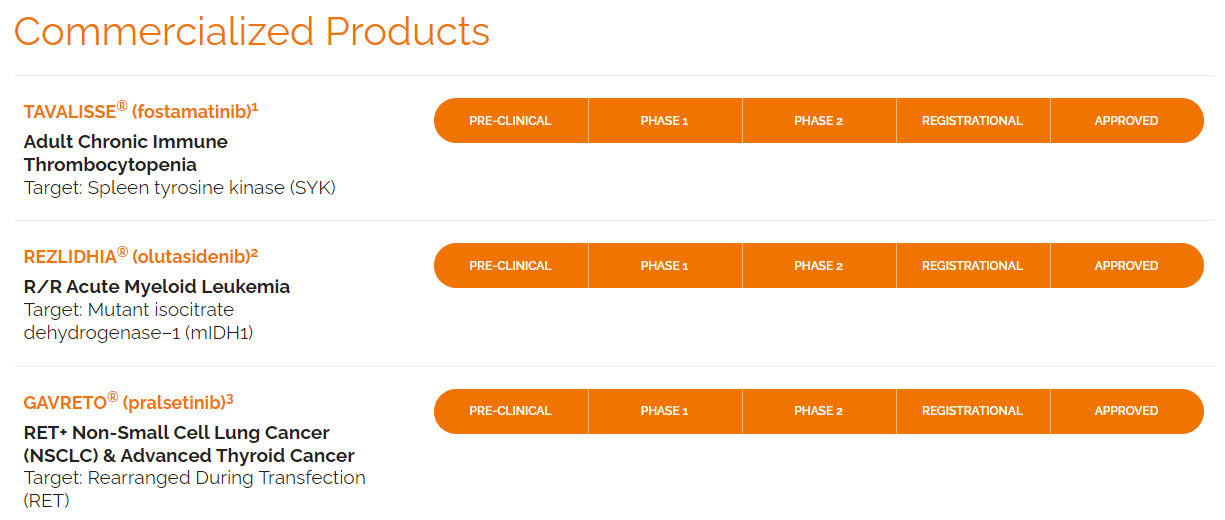

Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) is a biotechnology company focused on discovering and commercializing innovative therapeutics for hematological conditions and cancers. RIGL’s main FDA-approved products are Tavalisse, Rezlidhia, and Gavreto. Tavalisse targets SYK, Rezlidhia rrAML, and Gavreto NSCLC. In my analysis, I conclude that RIGL’s current valuation seems quite undervalued relative to its peers, particularly considering that it has a reasonable pathway toward becoming cash flow positive in the next few years. Hence, I deem RIGL a “strong buy” for investors aware of the inherent biotech risks.

Hematology and Oncology: Business Overview

RIGL creates and commercializes innovative therapeutics for hematological conditions and cancers. The company’s portfolio of FDA-approved products includes Tavalisse, Rezlidhia, and Gavreto. Recently, RIGL acquired the US rights for Gavreto, expanding its portfolio to include targeted medicines for RET fusion-positive metastatic NSCLC and advanced or metastatic thyroid cancer.

Source: Company’s website.

Moreover, RIGL’s pipeline also has promising drug candidates like R289 for lower-risk myelodysplastic syndromes [MDS], targeting IRAK1/4 to prevent inflammatory signaling. Tavalisse is an oral spleen tyrosine kinase [SYK] inhibitor indicated for chronic immune thrombocytopenia [ITP] in adults who have not responded adequately to previous treatments. It disrupts pathways that destroy platelets, restoring platelet count and improving clinical outcomes.

Source: Corporate Presentation. May 2024.

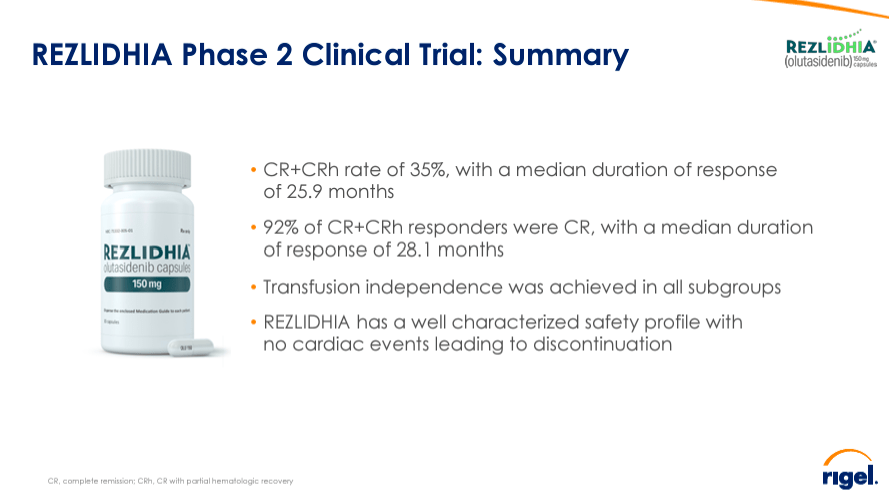

Furthermore, Rezlidhia (olutasidenib) is approved for relapsed or refractory AML. It inhibits mutated IDH1, an enzyme that intervenes in the citric acid cycle. IDH1 converts isocitrate to alpha-ketoglutarate [α-KG] in a cycle that generates adenosine triphosphate [ATP], a key molecule that provides cell energy. Thus, leukemia cells proliferate when mutations cause the IDH1 enzyme to produce oncometabolite R-2-hydroxyglutarate [2-HG] instead of α-KG. This means that Rezlidhia can theoretically treat leukemia by inhibiting IDH1.

Source: Mordor Intelligence.

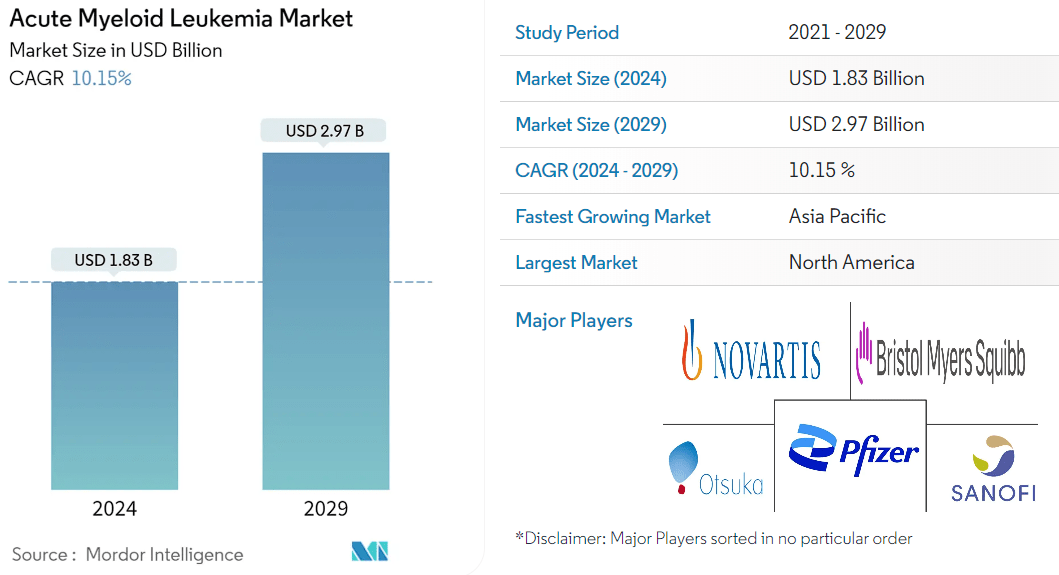

It’s worth mentioning that RIGL presented new trial data at the American Society of Clinical Oncology [ASCO] annual meeting from Rezlidhia’s phase 2 trial in patients who have undergone multiple lines of therapy with refractory/acute [R/R] myeloid leukemia [AML] with mutations in the isocitrate dehydrogenase 1 [IDH1] gene [mIDH1]. The results demonstrate that olutasidenib is an efficient option for treating these patients, particularly after venetoclax. AML is a relatively large market, estimated to reach $3.0 billion by 2029. So, I believe this phase 2 data could support RIGL in carving out a market niche in treating AML for this specific patient subset.

Product Pipeline: Progress and Updates

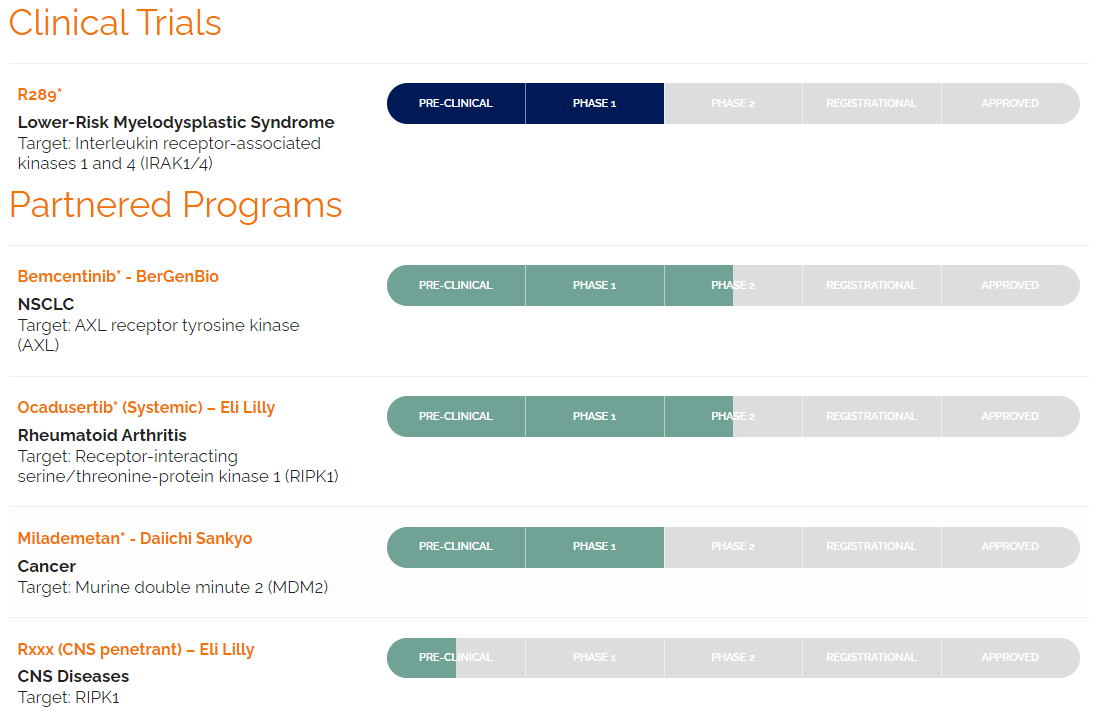

Additionally, the company’s pipeline includes other small-molecule inhibitors focusing on kinases related to specific diseases. One is R289, currently in Phase 1 for lower-risk myelodysplastic syndromes. This drug candidate targets the interleukin receptor-associated kinases 1 and 4 (IRAK1/4). Moreover, RIGL is also partnered with BerGenBio (OTC:BRRGF), Eli Lilly (LLY), and Daiichi Sankyo (OTCPK:DSKYF) for research programs that include bemcentinib, ocadusertib, and milademetan. Bemcentinib is being studied in Phase 2 and targets the AXL receptor tyrosine kinase for NSCLC. R552 is in Phase 2, targeting RIPK1 for non-CNS diseases, specifically evaluated for rheumatoid arthritis.

Source: Company’s website.

RIGL is also developing CNS-penetrant RIPK1 inhibitors in preclinical stages for CNS conditions. These inhibitors can penetrate the blood-brain barrier [BBB] and enter the CNS, which is crucial for the effectiveness of this type of therapy. Finally, the research candidate, milademetan, completed Phase 1 trials for cancer; it targets murine double minute 2 (MDM2). As previously noted, RIGL acquired the US rights to Gavreto from Blueprint Medicines Corporation (BPMC) in February 2024. This FDA-approved drug is indicated for rearranged during transfection [RET], fusion-positive metastatic non-small cell lung cancer [RET+ mNSCLC], and advanced or metastatic thyroid cancer [a/mTC].

In 2023, Gavreto generated around $28 million in revenues from the US alone. Its action mechanism inhibits RET kinase activity by binding to it, blocking signaling pathways essential for cancer cell survival and proliferation. As a result, Gavreto leads to tumor shrinkage with positive clinical outcomes. On June 24, 2024, RIGL announced the completion of the transfer of the NDA for Gavreto. Therefore, the company has only commercialized Gavreto for RET fusion-positive NSCLC or metastatic RET fusion-positive thyroid cancer since then. This is why Gavreto didn’t contribute to RIGL’s revenues in Q1 2024. It’s worth mentioning that Gavreto’s NSCLC indication was FDA-approved under an accelerated process, so its approval status requires confirmatory trial results.

Source: Corporate Presentation. May 2024.

Lastly, RIGL also presented R289’s Phase 1b trial results at the ASCO’s annual meeting. This trial involved patients with lower-risk myelodysplastic syndromes [MDS], bone marrow conditions characterized by symptoms like anemia, leukopenia with a risk of infections, and thrombocytopenia causing bleeding. R289’s action mechanism is based on IRAK1 and IRAK4 inhibitors that prevent inflammatory signaling pathways responsible for MDS symptoms. These dual inhibitions suppress inflammatory cytokine generation, restoring normal cell regeneration. Preliminary data suggest that R289 has a good safety profile with manageable side effects and hematological improvement of the condition, supporting further research of the drug candidate. However, it’s still a very early-stage drug, and since it’s just Phase 1b, it’s still many years away from any potential FDA approvals.

Cheap Price Tag: Valuation Analysis

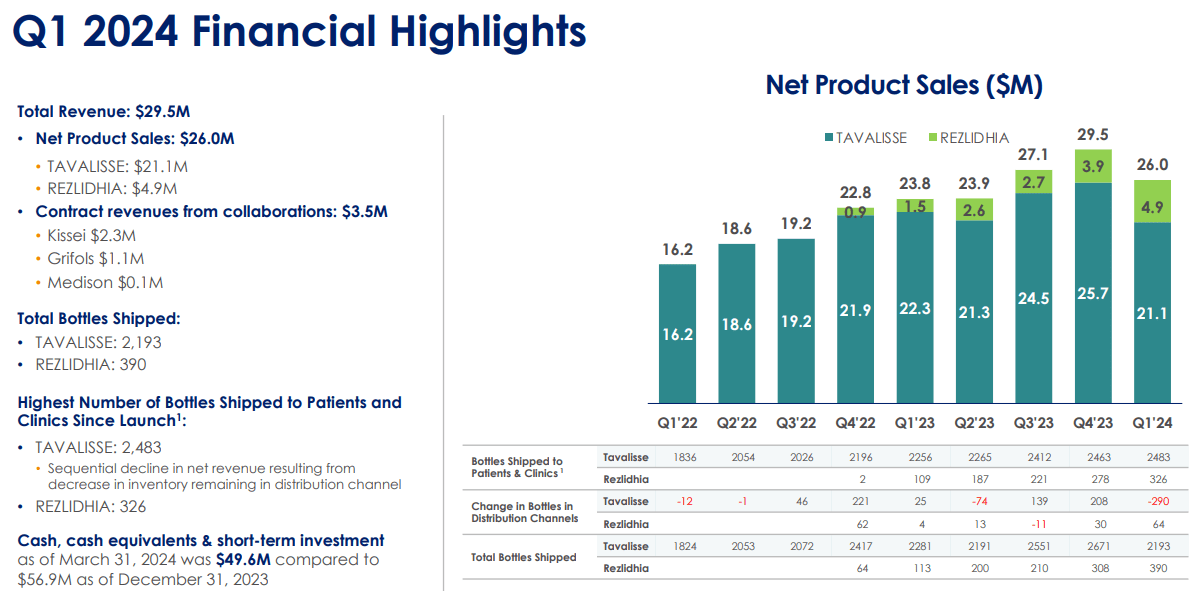

From a valuation perspective, the company trades at a $177.5 million market cap, making it a microcap biotech. Its balance sheet holds $25.6 million in cash and equivalents plus $24.0 million in short-term investments, totaling $49.6 million in available short-term funds against $59.7 million in financial debt. The company has $126.5 million in total assets and $158.2 million in total liabilities, resulting in a negative book value of $31.7 million. This means the best way to value RIGL is through its revenues.

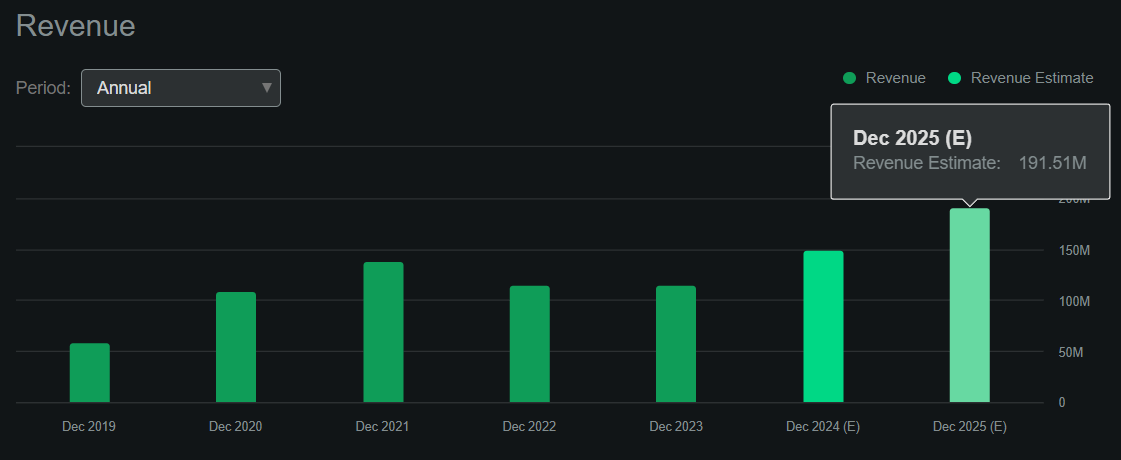

According to Seeking Alpha’s dashboard on RIGL, the company is forecasted to generate approximately $191.5 million in revenues by 2025. This would be a 28.0% YoY increase in 2024 revenues, and I imagine Gavreto’s future sales will significantly contribute to that growth. RIGL trades at a 0.9 forward P/S, which is self-evidently cheap. For context, its sector’s median forward P/S multiple is 3.9, making RIGL significantly relatively undervalued from that metric.

Source: Seeking Alpha.

I also estimate the company’s latest quarterly cash burn at $4.9 million by adding its CFOs and Net CAPEX. This implies an annual cash burn rate of $19.6 million. Therefore, I calculate the company’s cash runway at roughly 2.5 years, which is relatively healthy for a company projected to ramp up its revenues in the next few years. In fact, it’s likely that if revenues increase as expected, RIGL will turn cash flow positive by 2025. Its quarterly TTM operating expenses have remained relatively consistent between $101.8 million and $112.8 million since Q2 2022.

So if RIGL’s revenues grow to $191.5 million by 2025, then at the current quarterly gross margins of 76.0%, it’d have a positive EBIT of $145.5 million. Even at 50% gross margins, RIGL would have a positive EBIT, and at its depressed microcap valuation, I believe it represents a potential investment opportunity. As long as revenue grows as expected, RIGL should have ample flexibility to fund its research and operations for the foreseeable future. Therefore, it’s challenging to be bearish on a company with steady revenue growth potentially turning cash flow positive in the next few years that trades at a significant discount relative to peers. Hence, I think RIGL is a good “strong buy” for investors who believe in RIGL’s ability to generate cash flow and deleverage its balance sheet.

Investment Caveats: Risk Analysis

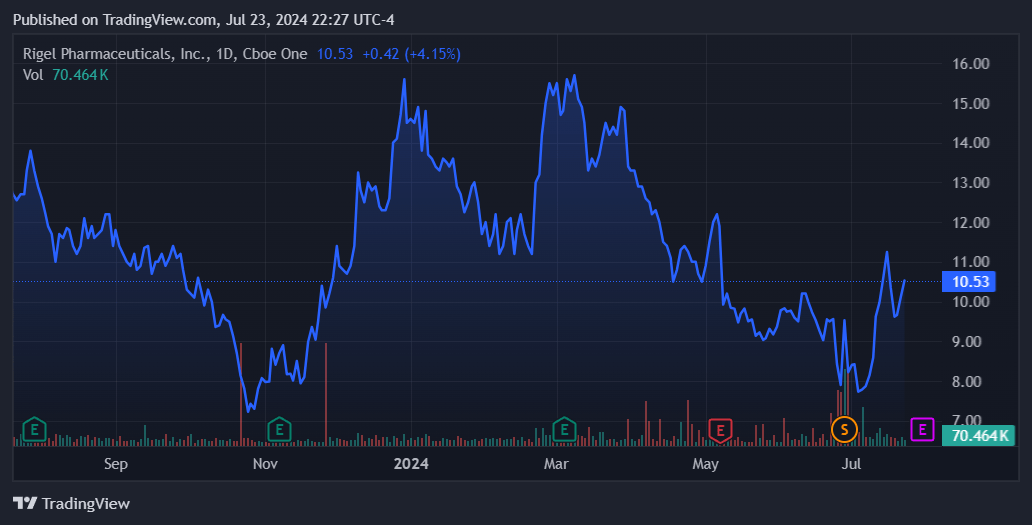

Naturally, this investment thesis has its risks. Particularly, the bull case relies on RIGL successfully commercializing Tavalisse and Rezlidhia while incorporating its newly acquired Gavreto IP. Any delays or setbacks in Gavreto’s commercialization efforts could significantly slow RIGL’s forecasted revenue growth. If this occurred, the assumption of RIGL becoming cash flow positive in the next few years would be derailed and could threaten its ability to fund operations without additional funds. Moreover, it’s worth mentioning that the hematology and oncology markets are notably highly competitive, with much larger and better-capitalized companies than RIGL itself.

Source: TradingView.

So, while RIGL’s future growth is promising, it’s not guaranteed. Nevertheless, despite these risks, I believe RIGL has a reasonably good chance of delivering on its objectives through its Tavalisse, Rezlidhia, and Gavreto. It also has a promising product pipeline that could generate new revenue verticals over time. So, I think the risks are justified, especially at such a depressed valuation multiple, which is why I lean towards a “strong-buy” rating on RIGL.

Strong Buy: Conclusion

Overall, RIGL is a promising microcap biotech with three revenue-generating products. Tavalisse, Rezlidhia, and Gavreto are on track to deliver enough revenues to make RIGL cash flow positive in the next few years, assuming its margins don’t significantly deteriorate while expanding its production. I reckon there are execution and competition risks embedded in this investment thesis, but RIGL seems to have a reasonably good chance of delivering on its potential. At its currently depressed valuation, I think RIGL is a “strong buy” for long-term biotech investors who understand the inherent biotech risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here