The big question mark on many investors’ minds this year has been what will happen with interest rates? When will the Fed decide to lower interest rates, and how will the timing of that decision impact my investments? Back in January, it was starting to look like rate cuts were imminent, and I even wrote an article cautioning against investing in a floating rate senior loan fund at the time, which turned out to be way too early. That article was about the Invesco Senior Income Trust (VVR), and I wrote, When Interest Rates Fall, Time To Bail. I rated VVR a Hold and since that article was published the fund has delivered a total return of 11.35%, nearly matching the S&P 500 change of 12.8%. I had posited at the time that when interest rates start to fall, those senior loans would pay less in interest payments, affecting the NII of the fund.

I still believe that thesis to be true and correct, but the timing of my call was off because the Fed was nowhere near reducing rates back in January. Now that we are about to start the month of July, there is still no indication that rate cuts are imminent, and likely not before September, if then. One fund that I recently came across is a relatively new ETF that offers a hedge against higher for longer interest rates, and it offers a nice return along with portfolio protection against rate risk. The ETF has a rather fancy name of FolioBeyond Alternative Income and Interest Rate Hedge ETF (NYSEARCA:RISR).

This ETF is not what I would consider a buy and hold and never check back on it again, fund. The fund had an inception date of 9/30/21 so it has not yet experienced a time when interest rates were falling. But the fund has performed extremely well since inception and offers a current 7% yield based on holdings of AAA rated investments that include US Treasuries and MBS (mortgage-backed securities).

I like RISR as a portfolio hedge against interest rates that are due to stay higher for longer, and one that offers a nice monthly income stream along with potential price appreciation until rates do eventually get cut. But similar to VVR, I would be looking to sell, or at least downgrade to a Hold and stop adding shares of RISR once the Fed does announce the first interest rate reduction.

RISR is a “Quantamental” Fund

From the fund website describing the fund strategy and positioning:

RISR is a “quantamental”, actively managed, scalable strategy which is positioned as a Diversifier for an existing fixed income portfolio regardless of one’s views on rates

Hedge for a fixed income allocation for those concerned about rising rates and who seek to shorten a portfolio’s duration without selling existing positions

Means of expressing a directional view for those who seek a vehicle designed to profit from rising rates

In other words, RISR can offer diversification in the fixed income portion of one’s portfolio while providing a hedge against higher interest rates and can leverage the macro view with price appreciation. The fund offers diversification benefits, helps to manage interest rate risk, and generates income under a wide range of interest rate environments.

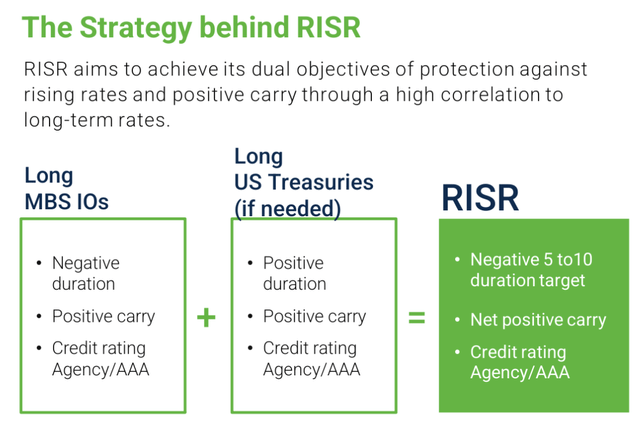

RISR invests primarily in interest-only mortgage-backed securities (MBS IOs) and U.S. Treasury bonds.

MBS IOs are a negative duration security that generally benefit from rising rates.

MBS IOs—and Treasuries to a lesser extent —generally provide income under stable rates.

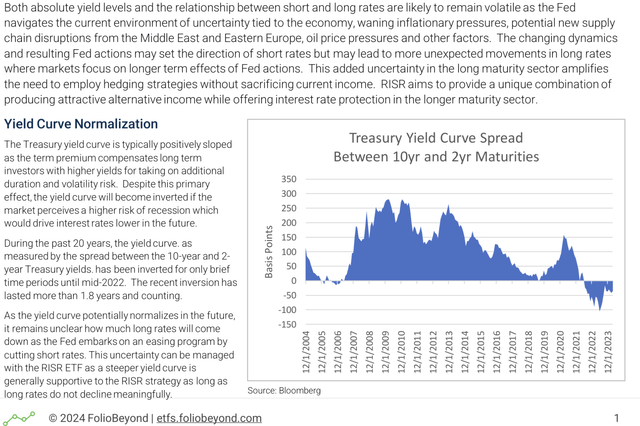

From the fund’s Investment Case document, the uncertainty in the yield curve leads to opportunities for this alternative investment strategy, which I find compelling:

RISR Investment Case

Even if short-term interest rates do fall, this ETF will still generate income from investments in AAA rated securities like Treasuries and MBS. The theory is that lower short-term rates could lead to mortgage buyers prepaying their loans to refinance at lower rates, thereby reducing the amount of interest received. However, in my opinion, that scenario is also likely to lead to increased demand for new mortgages as homebuyers who have been reluctant to take out new mortgages may consider doing so once rates do start to come down, somewhat offsetting that loss in interest payments.

In addition, the long US Treasury position could be increased as short-term rates decline, increasing the positive duration and helping to stabilize the income stream from those holdings. This strategy is further described in the Investment Case document.

RISR Investment Case

This strategy is further described in detail in the Summary Prospectus for the fund:

Conversely, when interest rates are falling, the rate at which borrowers prepay or refinance their mortgages tends to increase. As a result, the income from MBS IOs may decline and the market value of MBS IOs may decrease, which will result in a decline in MBS IO valuations. The Fund’s portfolio is structured such that a potential decline in MBS IO valuations may be partially offset by gains in the Fund’s U.S. Treasury positions, which have a positive duration, as discussed further below. In this scenario, the Fund’s portfolio will likely be rebalanced to bring the overall duration in line with the Duration Target Range, which will generally involve selling the U.S. Treasury positions and increasing the Fund’s holdings of MBS IOs. It should be noted, however, that in the case of MBS IOs, a default by an underlying borrower, will have the same effect as a voluntary prepayment (i.e., it will reduce the balance of the underlying mortgage pool, thereby reducing the market value of the MBS IO, notwithstanding such guarantee).

How Does AI Help?

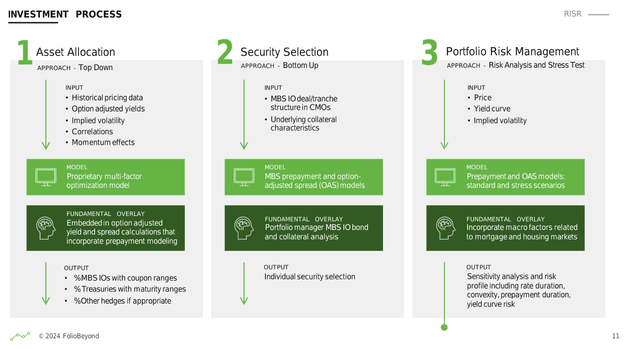

The fund sponsor behind RISR is called FolioBeyond, LLC. They are a registered investment adviser that was established in 2017. They call themselves a “Quantamental” investor because they combine quantitative and fundamental analysis with a machine learning, artificial intelligence approach to implement the strategy described above. According to the fund’s Investment Pitchbook, the solutions offered include “advanced proprietary algorithms for portfolio construction, asset allocation rebalancing, and stress testing.”

The investment process is diagrammatically outlined in that same Pitchbook document and shows a top-down asset allocation approach followed by a bottom-up security selection process.

RISR Investment Pitchbook

Monthly High Yield Income from AAA Rated Securities

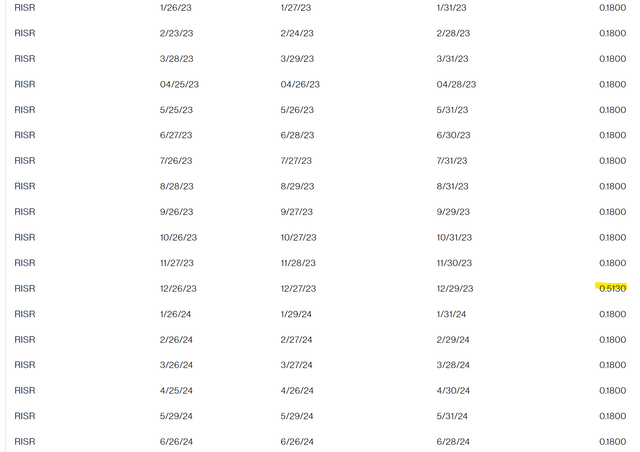

Although the price performance of the fund since inception is very impressive, the steady monthly income that RISR offers is one of the most attractive aspects for me. According to the fund website, the monthly dividend for the past 2 years has amounted to $0.18 per share and a special dividend of $0.5130 was paid in December 2023.

fund website

Fund Performance and Comparison to Other AAA rated ETFs

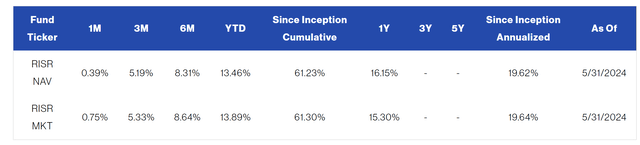

Although the RISR ETF has only been in existence for less than 3 years, its performance has been impressive in that time. According to the fund website, total return since inception has exceeded 60% and represents an average annual yield of nearly 20%.

fund website

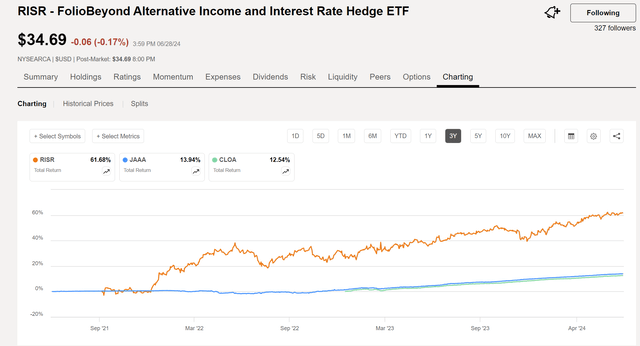

When comparing RISR to other AAA rated funds that offer similar yields of 6% to 7% such as JAAA or CLOA, the difference in performance due to capital appreciation in RISR since its inception is quite remarkable.

Seeking Alpha

And when comparing RISR to a plain vanilla investment grade bond fund such as the Fidelity Investment Grade Bond ETF (FIGB), the relative outperformance just in the past year is still very impressive.

Seeking Alpha

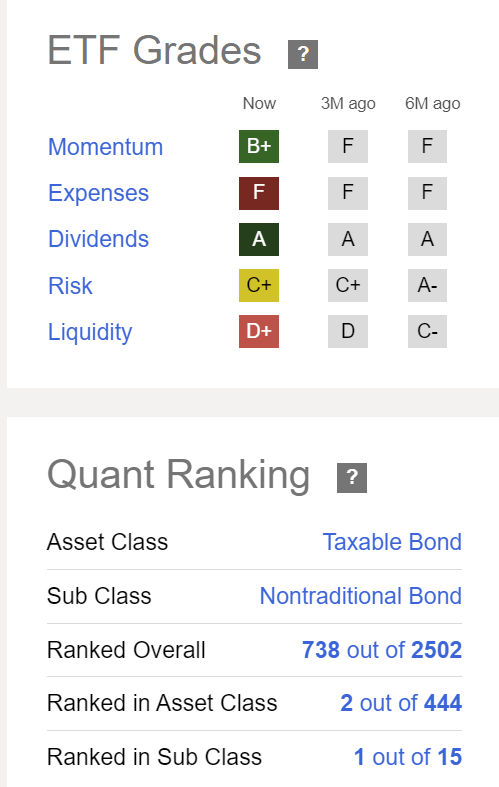

In fact, the SA Quant ratings indicate that RISR is #1 out of 15 in the nontraditional Bond sub-class and #2 out of 444 in the Taxable Bond asset class. The gross expense ratio of 1.13% is the only negative factor, and even that is not terrible for an actively managed ETF that offers a 7.2% dividend yield.

Seeking Alpha

Summary: Buy RISR for Monthly Income and a Portfolio Hedge Against High Interest Rates

As an income investor now in retirement, I am constantly on the lookout for opportunities to collect a high yield income stream, preferably paid on a monthly basis, that has some potential for capital appreciation (or at least avoids loss of capital invested over time). This relatively new ETF from FolioBeyond (using Tidal Investments as fund adviser) checks all those boxes for me and might be of interest to others who are looking for a similar investment. The fund is relatively small with about $61M in AUM and is subject to a number of risks that potential investors should be aware of, including the potential to drop in price once interest rates do get cut.

If you believe like I do that interest rates are likely to remain higher for longer as talks of reductions keep getting pushed farther out, it may be worth buying some shares of RISR now for the monthly income and for some protection in the fixed income portion of your portfolio. With a yield exceeding 7% annually from relatively low risk AAA-rated holdings such as US Treasuries and MBS securities, RISR offers a compelling alternative fixed income investment opportunity.

Read the full article here