Introduction

The markets are in turmoil.

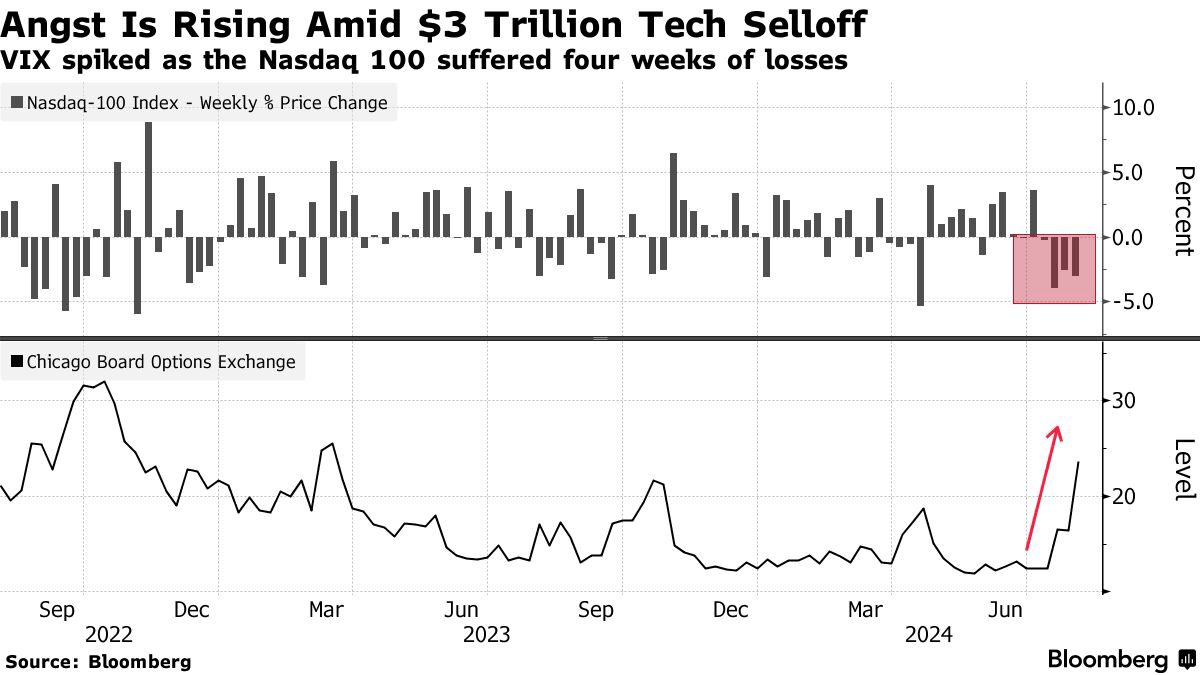

As reported by Bloomberg, big tech lost roughly $3 trillion in market value in less than a month, as the Nasdaq 100 has declined for four straight weeks.

Meanwhile, the VIX has spiked, indicating the highest volatility since 2022.

Bloomberg

On top of the fact that a lot of tech stocks were trading at a lofty valuation, it did not help that economic numbers have become incredibly weak.

- The ISM Manufacturing Index, including its new orders and employment components, hint at ongoing weakness in industrial sectors.

- Employment numbers are indicating a much higher unemployment rate and weak underlying hiring.

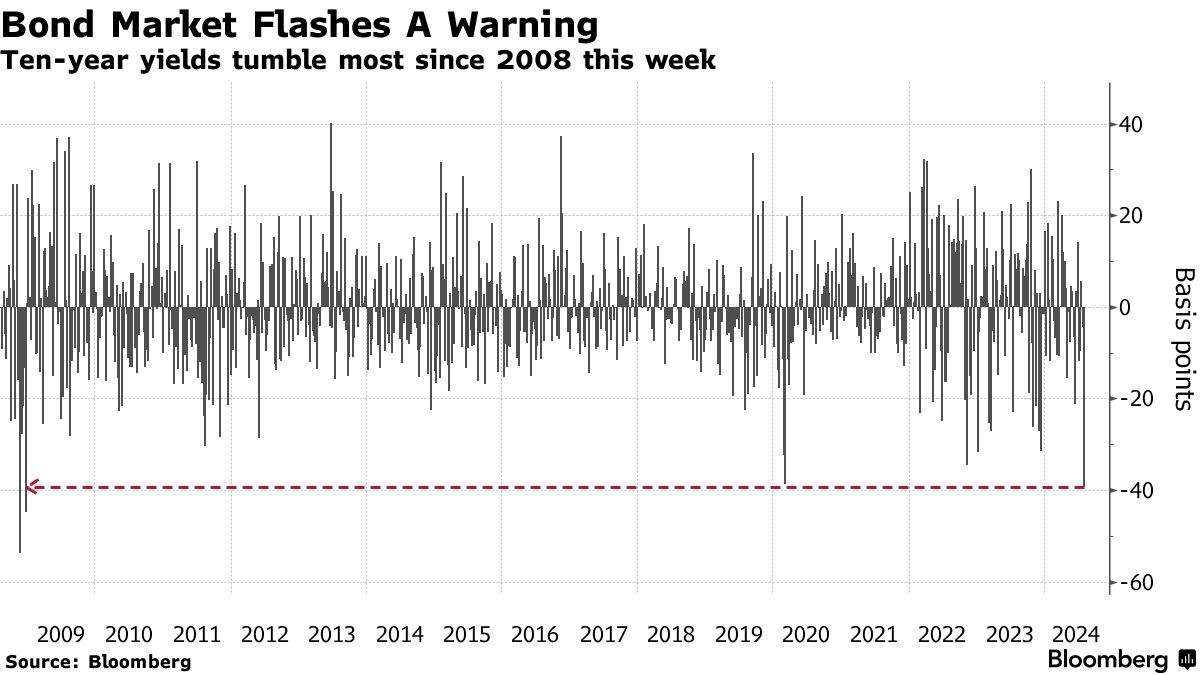

As such, the ten-year bond rate fell the most since 2008 as investors rushed for safety, betting on more weakness ahead.

Bloomberg

Needless to say, as a long-only investor, I’m somewhat suffering as well.

However, because I have been betting on value stocks instead of tech, my portfolio value is very close to its all-time high after July turned into one of my best months in recent years.

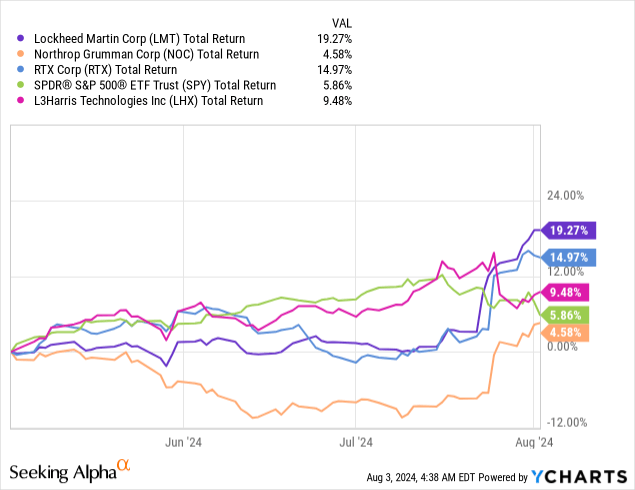

One of the reasons is my large investments in aerospace and defense companies, a sector that is finally showing what it is capable of.

Looking at the chart below, over the past three months, most major defense contractors have beaten the market, led by the RTX Corporation (NYSE:RTX), which returned 19% during this period.

As most readers might know, RTX Corp. is a stock I have been banging the table on for a very long time. Especially last year, when its stock price “tanked” due to GTF engine issues, I became very bullish, buying it with both hands for my personal account and all family accounts.

On October 16, I wrote an article titled “RTX Corp.: I’m So Bullish It Hurts.”

Although I really like catchy titles, the “So Bullish It Hurts” part is only for my absolutely favorite investments. Unless I’m forgetting something, I have applied this title to just three investments in recent years.

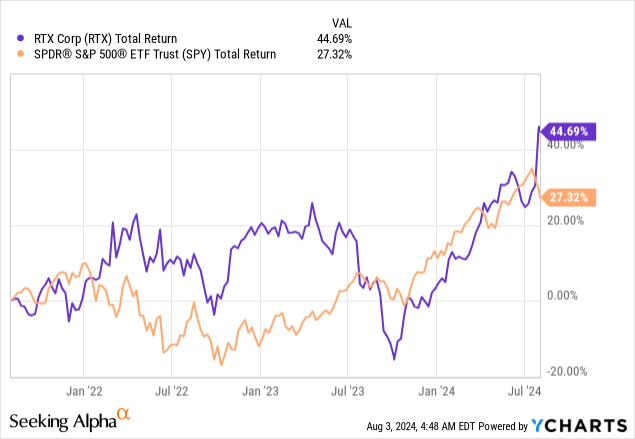

Since then, RTX shares are up 61%, including dividends, beating the 23% return of the S&P 500 by a wide margin.

My most recent article was written on July 11, when I wrote “Buying A $140 Stock For $100” in the title.

Since then, shares are up 16%, fueled by its recently released earnings. RTX has returned 45% over the past three years, as the company is finally showing the upside momentum I always thought it was capable of after a number of tough post-pandemic years.

That said, as much as I enjoy bragging about these returns, we cannot lose sight of what matters: assessing the risk/reward. After all, as it’s one of my largest investments and a core holding in all family accounts, there’s no room for error.

Hence, in this article, I’ll update my thesis, using its just-released earnings and new industry developments to explain why I am actually upping my target, expecting RTX to maintain elevated returns, even for investors who may be “late to the party.”

Bulls Are Back

Ever since the first pandemic lockdowns ended, I have been a buyer of aerospace and defense companies. Even the companies with limited commercial exposure were down back then, pressured by severe supply chain issues and defense budget uncertainty.

I went so far that, at one point, a quarter of my entire portfolio was invested in defense companies.

However, the past few years weren’t always fun, as supply chain problems were persistent, often leading to poor margins despite strong revenue growth. Also, some defense companies had issues with major programs, while budget uncertainty in the nation’s capital did not help, either.

Now, the defense industry is coming back roaring, which is giving my portfolio a boost at a time when the market, in general, is starting to struggle.

Most of this strength was “unlocked” by 2Q24 earnings, as most defense companies finally reported strong earnings, improving margins, and higher-than-expected guidance. One of these companies is the star of this article, RTX.

On July 31, Bank of America came out, hiking its price target to $140, which is also the target I gave in my July 11 article.

Seeking Alpha

As reported by Seeking Alpha (emphasis added):

“RTX has shown no signs of waning demand,” Ronald Epstein, analyst at BofA, said in a July 31 report.

RTX’s business units include jet-engine maker Pratt & Whitney and aircraft parts maker Collins Aerospace. Pratt & Whitney in the past year has worked to overcome defects discovered in its geared turbofan, or GTF, jet engines that power some models of Airbus narrowbody planes.

[…]

“In a threat environment more belligerent than the recent past, investors have continually asked, ‘where is the defense revenue and margin growth?’” Epstein said. “On an adjusted basis, 2Q marked further evidence the business is finally turning over a new leaf. Revenue was up 4% organically, and margins improved 100 basis points year over year.”

“Turning over a new leaf” is a key part of the quote above, as it seems that we’re now finally at a point where investors see the light at the end of the tunnel for RTX. Worries about supply chain issues and GTF costs are now replaced by optimism about the company’s massive footprint in commercial and defense industries, the tailwinds in both industries and its ability to generate impressive shareholder value.

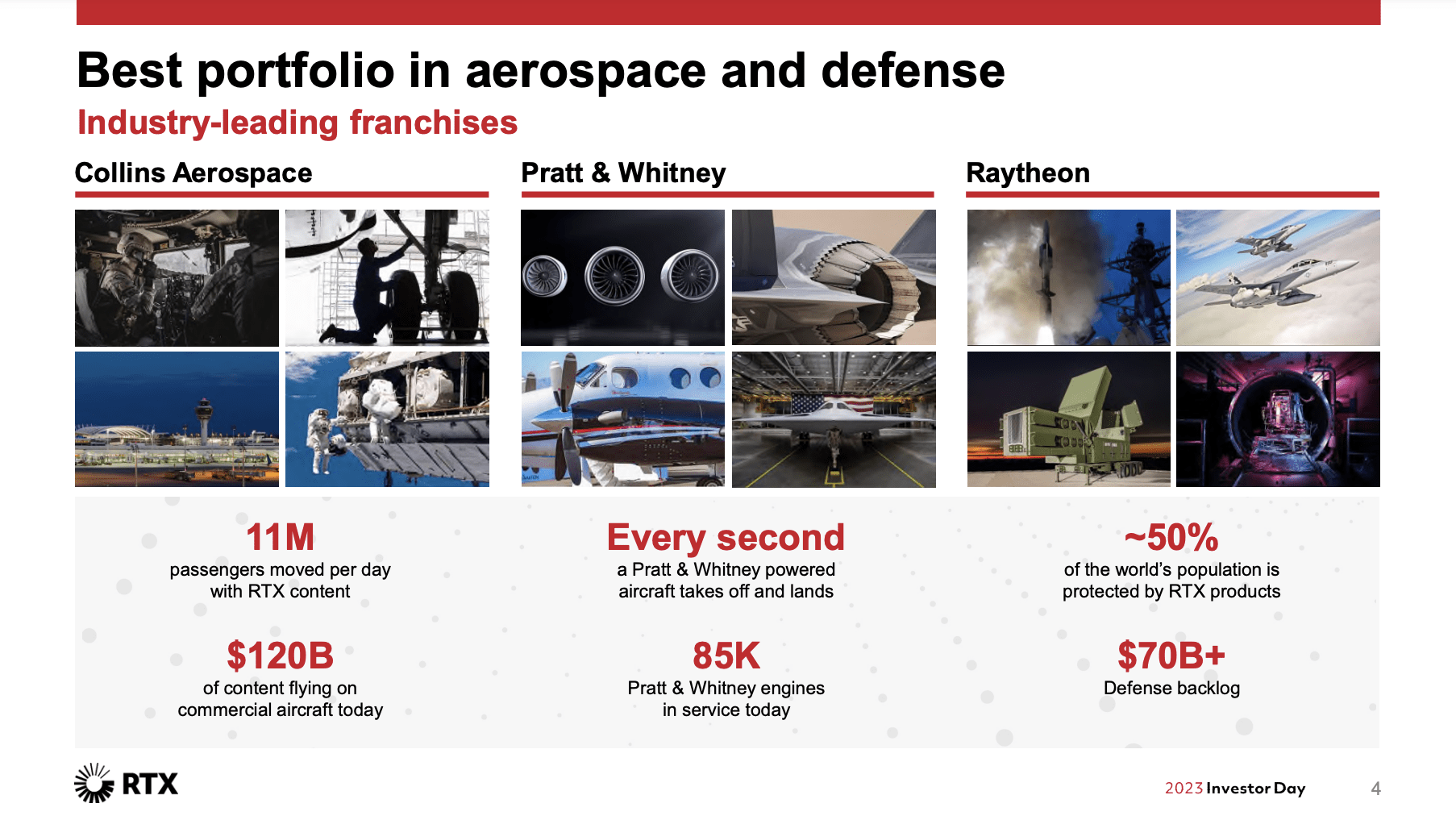

After all, what sets RTX apart from some of its peers is its footprint in commercial and defense, serving two fast-growing industries with different demand profiles.

In fact, despite the benefits that may come with a heightened global geopolitical threat level for defense demand, I have become an even bigger fan of its commercial business, which includes Pratt & Whitney (engines) and Collins Aerospace, which sells a countless range of supplies, including landing gears, avionics, advanced materials, business class seats, and even bathroom lights. This allows RTX to benefit from more or less every single commercial aerospace program in the world.

RTX Corporation

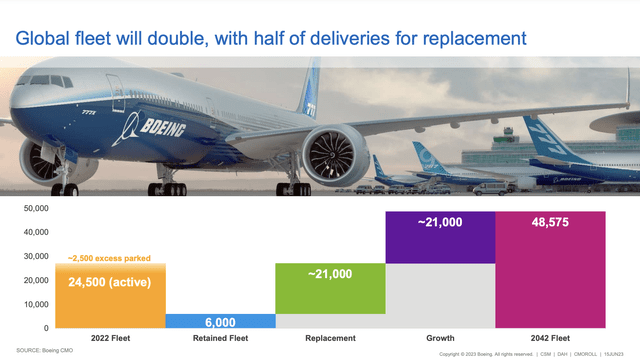

In my last article, I wrote that Boeing expects the global airline fleet to double to more than 48 thousand planes by 2042, with demand for more than 40 thousand new planes. As I have said for more than a decade, this is an industry I want to benefit from.

Boeing Company

Based on this context, let’s dive a bit deeper into its numbers and recent developments, as there’s a lot to unpack.

When Everything Goes Right

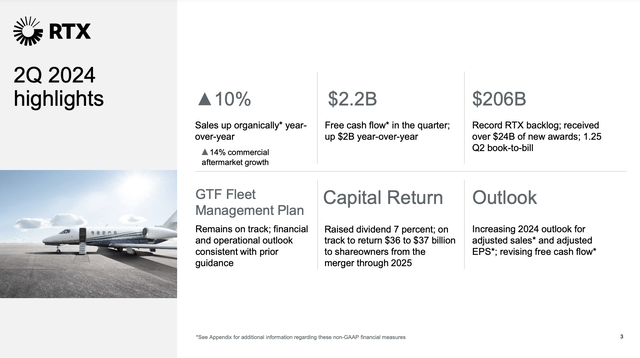

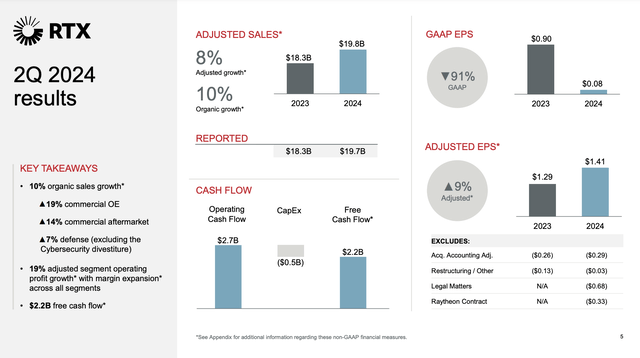

The second quarter of this year may be the best quarter since the 2020 merger between United Technologies and Raytheon, as the company reported $19.8 billion in sales, indicating 10% organic growth.

Additionally, growth was fueled by a 19% rise in commercial Original Equipment (“OE”) sales, which reflects continued demand in the aircraft sector, and a 14% increase in commercial aftermarket sales, which benefits from the ongoing recovery in domestic, international, and long-haul travel.

Meanwhile, the defense segment also contributed significantly, with a 7% increase in sales, excluding the impact of the Raytheon cybersecurity divestiture.

The best thing about this is that the company reported a massive acceleration in demand. The company received $24 billion(!) in new rewards, pushing the backlog to $206 billion with a book-to-bill ratio of 1.25x, indicating $1.25 in new orders for every dollar in finished work.

RTX Corporation

These numbers are mighty impressive and proof of widespread demand improvements.

Some of these rewards include roughly $640 million for SPY-6 radar production for the U.S. Navy, high demand for commercial GTF engines, and MRO (maintenance, repair, and overhaul) deals with Air Canada, among many other benefits that we will discuss in this article.

In the defense segment, it got $5 billion in new orders, boosting the backlog to $51 billion (1.13x book-to-bill). This growth was driven by major programs like the Patriot system (for customers like Germany), counter-UAS (anti-drone) systems, and programs like the Stinger (portable anti-air).

In other words, many of these programs benefit from the ongoing war in Ukraine and the fact that Europe needs to modernize its defense forces.

RTX Corporation

In fact, Europe’s demand for modernization includes major deals with nations like Poland for $2.1 billion to start the production of Lower-Tier Air and Missile Defense Sensors (“LTAMDS”).

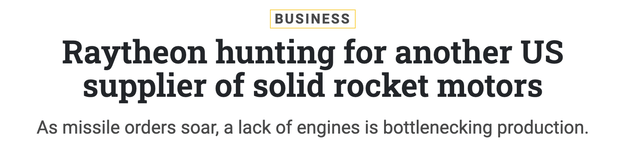

As reported by Defense One, demand for missiles is so strong that RTX is sourcing additional suppliers for rocket motors to keep up with new orders.

Defense One

The company also announced $7.5 billion in annual R&D spending, focusing on staying on top in key areas like sustainability, advanced propulsion, next-generation sensing, and hypersonics, which are missiles flying at more than 5x the speed of sound.

Even better, margins improved, as the company achieved an operating profit of $2.4 billion, a 19% year-over-year increase due to a 100 basis points increase in operating margins.

RTX Corporation

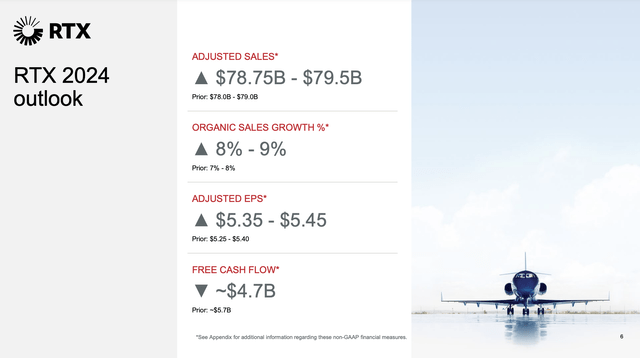

On top of that, the company hiked its guidance. It now expects adjusted sales to range between $78.75 billion and $79.5 billion, with an expected organic sales growth of 8% to 9%. That’s up from the previous guidance of 7% to 8%.

As we can see below, the company also increased its adjusted EPS guidance to a range of $5.35 to $5.45, supported by favorable tailwinds like lower interest and corporate expenses, increased pension income, and a lower full-year effective tax rate.

RTX Corporation

However, the free cash flow outlook has been adjusted from $5.7 billion to $4.7 billion due to legal and contract matters. As these issues are one-off items that are not expected to have a lasting impact on the business, this did not ruin the party.

As one can imagine, this is great news for shareholders.

Shareholder Distributions & Valuation

Buybacks and dividends. That’s how RTX aims to distribute up to $37 billion between the 2020 merger and the end of next year.

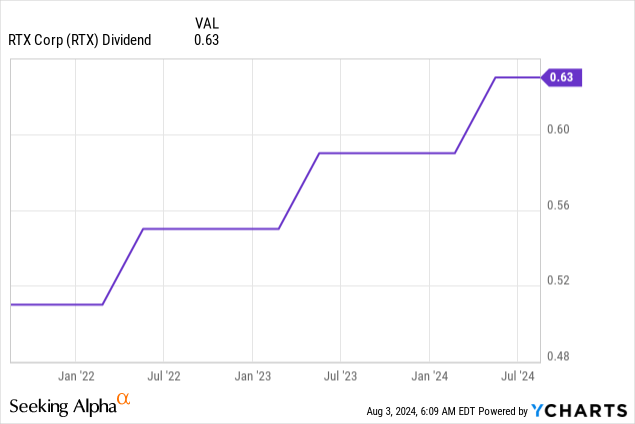

The most recent dividend hike was on May 3, when RTX hiked by 6.8% to $0.63 per share. This translates to an annual per-share dividend of $2.52 and a yield of 2.2%.

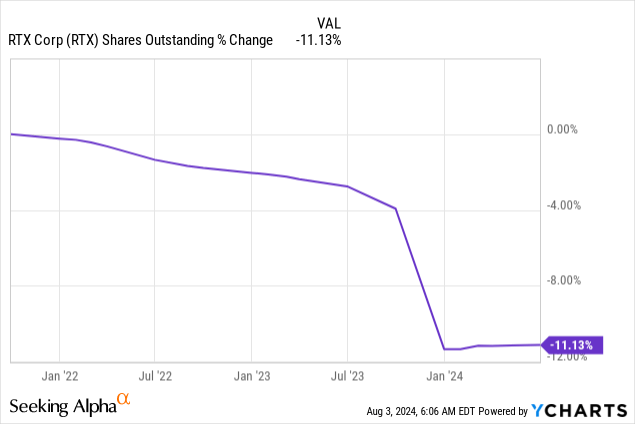

This dividend is protected by a 45% payout ratio and a very favorable long-term earnings outlook. However, before we get to that, I want to use the chart below to show that RTX has bought back 11% of its shares over the past three years, mainly due to accelerated buybacks after last year’s sell-off.

The company remains in a great spot to maintain elevated buybacks, as it has a healthy balance sheet with a 2025E net leverage ratio of 2.4x and a BBB+ credit rating. That’s one step below the A range.

Moreover, based on analyst estimates, free cash flow is expected to rise to $8.3 billion in 2026, implying a 5.4% free cash flow yield. In other words, this protects the 2.2% dividend and paves the road for close to $5 billion in annual buybacks – theoretically speaking.

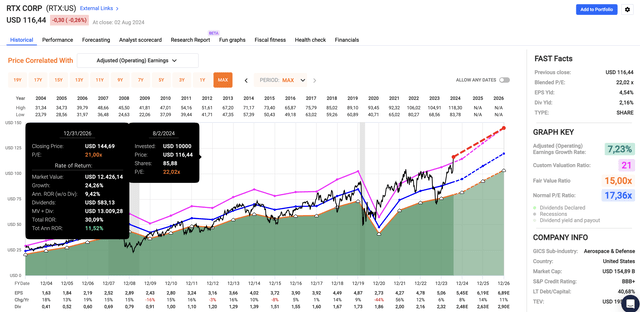

With regard to its valuation, using the FactSet data in the chart below, analysts are still looking for roughly $6.90 in 2026 EPS. That is unchanged compared to my July article.

Although I expect that number to rise in the years ahead, even a 21x multiple implies a fair stock price of $144, 24% above the current price.

FAST Graphs

In this case, as you just saw, I’m also upping my P/E multiple from 20x to 21x, as I believe the market has finally realized what RTX (and its high-quality peers) are capable of in an environment where both commercial and defense demand is accelerating with fewer headwinds.

As such, I stick to my Strong Buy rating and will continue to gradually add to my already large position on dips.

Takeaway

My heavy investment in RTX continues to pay off, with the stock outperforming the market significantly over the past three years, supported by increasing momentum since last year.

The company’s fantastic second-quarter performance, strong demand across commercial and defense sectors, and improved margins justify a raised price target.

Despite some challenges, RTX’s strategic position in high-growth industries and its commitment to shareholder returns make it a highly compelling investment – even after its recent rally.

Hence, I’ll continue to add to my position, confident in its ability to deliver impressive returns even in light of broader market uncertainty.

Pros & Cons

Pros:

- Diversified Portfolio: RTX’s large footprint in both commercial and defense sectors provides stability and growth opportunities.

- Solid Earnings & Growth: The latest earnings report showed significant revenue growth, improved margins, and a full backlog, indicating strong future growth.

- Shareholder Returns: With consistent dividends and aggressive buybacks, RTX is committed to returning cash to shareholders.

Cons:

- Supply Chain Challenges: Persistent supply chain issues can impact margins and delivery timelines, potentially posing a risk to consistent performance.

- Geopolitical and Budget Uncertainty: Defense budget fluctuations and geopolitical tensions can affect demand and project funding, creating potential volatility.

- Historical Challenges: Past issues, such as the GTF engine problems, highlight potential operational risks.

- Economic Sensitivity: Commercial aerospace recovery is tied to global economic conditions, which can be volatile.

Read the full article here