Salesforce Dropped 20% After Q1 Earnings

I covered Salesforce (NYSE:CRM) for the first time in February, and I put out a Buy rating, even though I warned of the valuation risk and mentioned that a smaller allocation might be wiser due to potential volatility in AI stocks to come. Now, after Q1 fiscal 2025 earnings, the stock has dropped ~20% in price. The company missed its revenue estimate by $13.38 million; even though revenue for the period increased 11% YoY and free cash flow was up 43% YoY, investors did not take kindly to the indicated revenue growth contraction. I think this reaction to Salesforce’s quarterly results is unwarranted, although I do believe that the sentiment that Salesforce could be entering a period of slower growth due to macroeconomic stagnation in many core markets is accurate. In essence, this might be a buying opportunity. David Friedberg mentioned an interesting point in the most recent All-In Podcast, released on Friday, 31st May, that there could be a commoditization of AI underway, which significantly devalues the status of what Salesforce is offering when consumers can get generative AI solutions for a much cheaper and democratized price. There are many companies already developing the tools to make business solutions using AI at a greatly reduced price. In some respects, this significantly reduces some of the value that Salesforce could have in the market long-term. That being said, I think the stock has much more life in it, and I believe that the company’s management will be able to strategically readjust in offering new services that fulfil cheaper demand. The commoditization of AI could be “the beginning of the end” for Salesforce if it doesn’t readjust, but I don’t believe the end is anywhere near yet. In the same podcast episode, David Sacks mentioned how CEO Marc Benioff adopts an agile approach to running Salesforce, which could be favorable for the company if it manages to again adapt to the changing market dynamics; I think it will, even if Salesforce is in the second half of its life as a business.

| Cloud-Based CRM (1999) | Salesforce pioneered SaaS with its cloud-based CRM, disrupting traditional software and gaining market share. |

| AppExchange (2005) | Launched AppExchange, fostering a third-party app ecosystem, extending CRM functionality, and enhancing platform value. |

| Strategic Acquisitions | Expanded capabilities and market reach through acquisitions like ExactTarget, MuleSoft, Tableau, and Slack. |

| Einstein AI (2016) | Introduced Einstein AI, embedding advanced analytics and automation into CRM, maintaining a competitive edge. |

| COVID-19 and Slack (2020) | Supported remote work during the pandemic, acquiring Slack to enhance collaboration tools and demonstrating adaptability. |

The ~20% drop in Salesforce stock comes at a time when I believe there is some irrational exuberance in the markets related to many AI companies; however, I don’t consider Salesforce to be significantly overvalued. It was likely slightly overvalued prior to the revenue miss and certainly undervalued after it. I will explain this in more detail in my valuation analysis below. What I believe is important for investors to recognize is that there is going to be volatility in the stock price of companies involved in AI, even if they do not deserve it like some other companies definitely will. The reason I believe this is true is that many of these technology stocks move in tandem, often grouped in ETFs, and also associated by public market investors as ‘AI stocks’ rather than correctly analyzed for particular strengths and weaknesses, including rigorous assessment of company valuations. I think this is going to open up many opportunities at times for good value in AI stocks. In the case of Salesforce, I believe what we have now is an AI stalwart selling at below intrinsic value after the recent drop.

Peer Analysis

In the following table are perhaps the greatest competitors to Salesforce, each of which I consider stalwarts. I have included comparisons of the major financial and valuation metrics for the purposes of this discussion surrounding Salesforce’s relative investment merit at this time.

| ______________________ | Salesforce | Microsoft (MSFT) | SAP (SAP) | Oracle (ORCL) | Adobe (ADBE) |

| FWD Revenue Growth 5Y Avg | 19.69% | 13% | 4.41% | 5.33% | 15.73% |

| FWD Diluted EPS Growth 5Y Avg | 16.75% | 15.71% | 3.16% | 9.03% | 19.72% |

| FWD Free Cash Flow Growth 5Y Avg | 22.23% | 12.69% | 15.16% | 7.16% | 15.95% |

| TTM Net Income Margin 5Y Avg | 7.23% | 34.4% | 15.44% | 23.63% | 30.3% |

| Equity-to-Asset Ratio | 0.62 | 0.52 | 0.59 | 0.04 | 0.54 |

| FWD P/E GAAP Ratio | 38.5 | 35 | 60.5 | 31 | 37.5 |

| FWD P/S Ratio | 6 | 12.5 | 5.5 | 6 | 9.5 |

This table clearly shows good growth for Salesforce and a valuation that isn’t too rich considering the multiples of the other peers besides SAP. Salesforce is notably weak in net income margin, but it makes up for this somewhat in higher levels of free cash flow growth at the moment. In my opinion, it isn’t too late to invest in Salesforce as a stalwart investment, especially at the new 20% reduction in price from previous levels. However, I think investors should begin to expect some slower growth moving forward as the company potentially has to restructure parts of its organization and business model to fit the new climate of commercial and mainstream adoption in AI, including many open-source models and some interfaces that are free to use, or available at extremely low prices. As society starts to shift toward an economy that is more focused on individual creators and smaller businesses, including what I predict will be many more people who are self-employed and empowered by AI systems, it will become increasingly difficult for larger enterprises to retain a moat. I believe the large companies that will thrive in the future economy will be those that supply the infrastructure for AI users, for example foundation models, data center providers, and chip producers. Salesforce doesn’t operate a foundation model at this time. However, it does have Einstein AI, which is an AI layer that could be utilized in a more democratic commercial AI environment that is likely to evolve in the future. Salesforce uses a combination of its own data centers, but it is also reliant on the public cloud infrastructure of AWS (AMZN), Azure, and GCP (GOOGL) (GOOG); additionally, Salesforce does not design its own AI chips and relies on cloud providers’ AI hardware. Based on this information, it seems unlikely to me that Salesforce has as enduring a moat in the future economy as AWS, Microsoft, and Google have, as key examples. Salesforce may find itself drowned out by big tech companies and small self-employed AI users, finding the use case for enterprise AI greatly reduced as a result and contracting the company’s growth over the next 10-20 years.

The Valuation Remains Appealing For Now

Given my typical 10+ year holding period ambition, investors may wonder why I consider Salesforce still a Buy at this time. The primary reason is that I believe the shifts I have outlined above will happen gradually. As such, I expect the stock to continue to deliver for shareholders over the next decade at least. If Salesforce can manage to recalibrate itself according to the dynamics I and others have outlined that I mentioned above, then Salesforce could deliver alpha for a few decades more.

What needs to be recognized by long-term Salesforce shareholders who may be doubting their position in Salesforce stock since the ~20% drop in price is that based on intrinsic value from a conservative DCF model, Salesforce is actually undervalued now. This is rare for a company of its size in such a high-growth industry like AI.

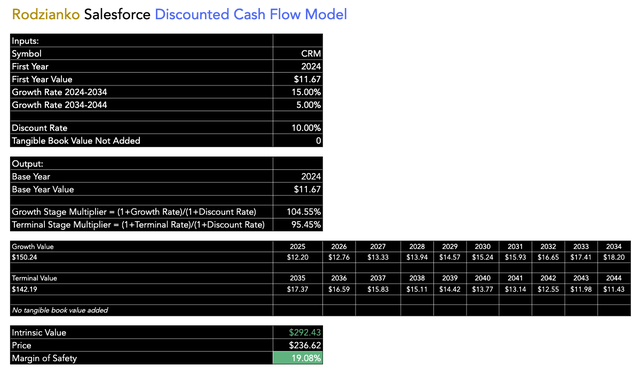

In my model, I used a 10% discount rate, which I consider the standard annual market return. I used a 15% free cash flow per share annual growth rate for the first 10 years of my DCF model. Following this, I used 5% free cash flow per share annual growth for 10 years. I consider this conservative, but it does price in some of the contraction in growth which could occur based on the above operational considerations I outlined. The indicated margin of safety on Salesforce stock at this time is ~19%:

Author’s Model

Key Elements

Salesforce stock dropped ~20% in price after its Q1 fiscal 2025 earnings results. The company reported a ~$14 million miss of its revenue expectation. This opened up a cacophony of negative sentiment around the valuation of the company, which I believe was anticipative of future growth challenges but still largely unwarranted.

Salesforce may deal with a new economy in the future where AI systems are highly democratized and available for extremely cheap prices, sometimes even free. As we are likely going to go through a highly deflationary period when robotics becomes mainstream, AI systems like those offered by Salesforce at current prices are likely to become unmatched by demand pricing. However, I do not see this occurring heavily until 10-20 years from now.

While the risks need to be recognized, the stock remains a stalwart investment for the next decade at least, and the intrinsic value of the company is roughly 20% undervalued by my conservative DCF model at the time of this writing. I reiterate my Buy rating for Salesforce stock at the current reduced price.

Conclusion

I am a Salesforce shareholder, and I am considering buying more of the stock at the current price. I believe the company will face existential challenges over the next few decades, but I see it likely that it will be able to manage this with the agility that it has proven capable of over its lifecycle already. The undervaluation of roughly 20% at the moment from its intrinsic value is a compelling reason to invest, in my opinion.

Read the full article here