Sixth Street Lending Inc. (NYSE:TSLX) is a well-managed business development company which a First Lien-centric, floating-rate investment portfolio, strong originations in the first quarter and a dividend yield of 9% that is covered by the BDC’s net investment income.

The central bank last week essentially guided for a higher-for-longer rate environment which might aid the BDC’s growth in the short-term. In the long-term, though, I don’t anticipate much growth in net investment income.

Taking into account that Sixth Street Lending is selling for a 23% premium to net asset value, I think that the risk/reward relationship is not compelling, even though the central bank guided for only one rate cut in 2024.

My Rating History

Sixth Street Lending’s rebound in originations and healthy pay-out ratio led me to classify the BDC’s stock as a Hold a couple of months ago. What underpinned my ‘Hold’ recommendation primarily was that the central bank was anticipated to bring a quick end to the rate-hiking cycle in 2024. The central bank has changed its tune a little bit and now anticipates only one change to short-term interest rates this year.

Despite a higher-for-longer rate environment, however, I think that TSLX is too expensive and I don’t see much upside left in the tank in 2024.

Portfolio Review, Originations And Pressure On The BDC’s Net Interest Margin

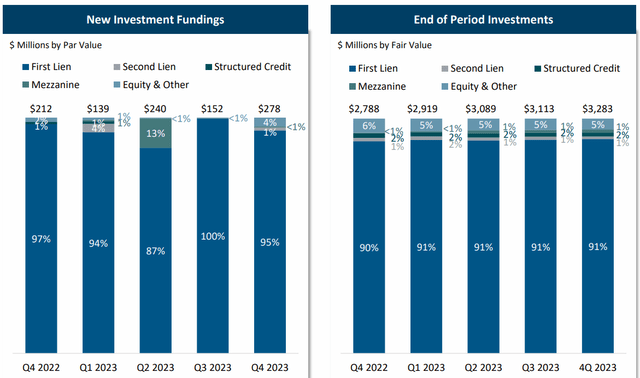

Sixth Street Lending’s investment portfolio as of March 31, 2024 consisted primarily of First Lien investments that accounted for 92% of the business development company’s portfolio, representing a 1 percentage point increase compared to the prior quarter.

In terms of new investment fundings, 95% of new investments were once again made in First Liens, showing no deviation from second quarter origination levels.

As a First Lien-centric BDC, I will compare Sixth Street Lending to Goldman Sachs BDC Inc. (GSBD) and Golub Capital BDC Inc. (GBDC). Goldman Sachs BDC was 97% First Lien invested in 1Q24 whereas Golub Capital BDC was 93% First Lien-centric.

New Investment Fundings (Sixth Street Lending)

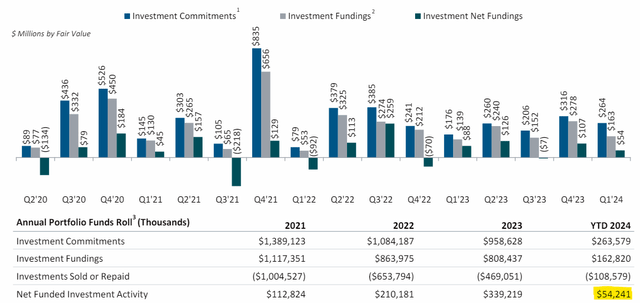

Sixth Street Lending had $163 million in new investment fundings in 1Q24 which, like I just pointed to, were mostly First Lien. Subtracting the amount of investments sold or repaid, the BDC had a net fundings of $54.2 million which caused the BDC’s portfolio value to stand at $3.38 billion as of March 31, 2024.

Net Funded Investment Activity (Sixth Street Lending)

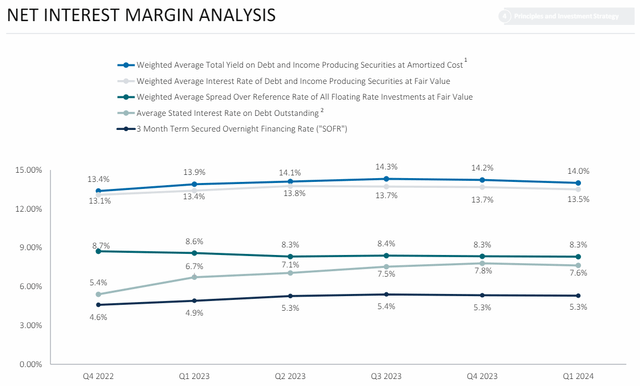

Sixth Street Lending is First Lien-focused and 100% floating-rate positioned, meaning it is a directional bet on interest rates. In this regard, the longer the central bank keeps interest rates high, the stronger the NII tailwind that Sixth Street Lending gets to reap.

As far as yields are concerned, Sixth Street Lending thus continues to profit from an elevated yield environment as well: It produced a 13.5% yield on its income-generating investments in 1Q24 which was practically unchanged compared to the period a year ago.

Net Interest Margin Analysis (Sixth Street Lending)

Dividend Coverage Deteriorated In 1Q24

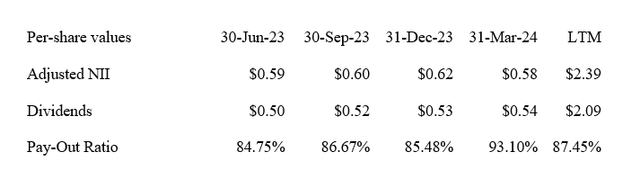

Sixth Street Lending has decent pay-out metrics, meaning the business development company consistently covered its dividend and had a pay-out ratio ranging from the mid-80s to the low-90s range, with the twelve months dividend pay-out ratio being 87%.

This is not different from many other business development companies that I have penned articles about in the recent past, including Goldman Sachs BDC and Golub Capital BDC which had pay-out ratios of 76% and 84%, respectively, in the last twelve months.

Dividend (Author Created Table Using Company Supplements)

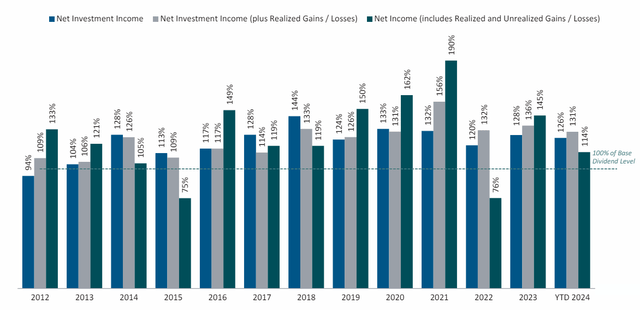

The historical pay-out trend is also in favor of Sixth Street Lending which only under-earned its dividend once, in 2014. Since then, the BDC has consistently covered its dividend with net investment income, producing an average NII dividend pay-out ratio, on an annual basis, of 81% which is equal to a NII-based dividend coverage ratio of 122% (I am using the calculation here between the years 2012 until 2023).

Net Investment Income (Sixth Street Lending)

TSLX’s 24% Premium Indicates Full Valuation

As I have said numerous times in my articles particularly about floating-rate business development companies, I don’t see much re-rating potential in an environment of falling interest rates because recent net investment income tailwinds.

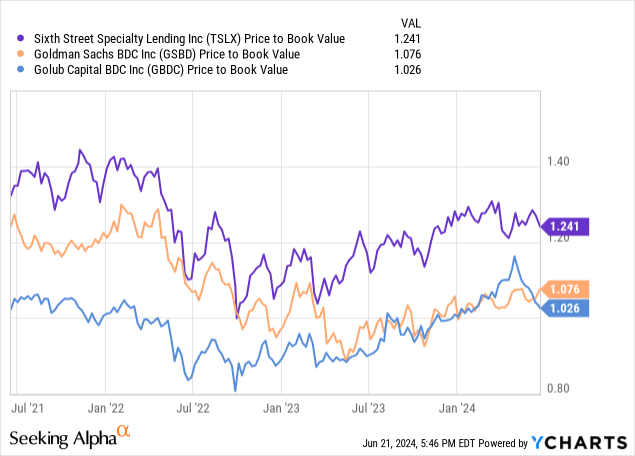

Sixth Street Lending is presently valued at a 24% NAV premium with the last reported net asset value (as of March 31, 2024) being $17.17 (implied intrinsic value).

Taking into account that TSLX covers its dividend with net investment income and is geared towards floating-rate loans, I think the BDC could see at a premium to NAV as long as the central bank doesn’t slash rates. Once it does, however, I think the valuation picture will change and the net asset value premium may gradually disappear.

Furthermore, peer BDCs Goldman Sachs BDC and Golub Capital BDC sell for much lower 7% and 3% premiums to NAV.

Why The Investment Thesis Might Disappoint

Sixth Street Lending is a 100% floating-rate BDC and thus will be dealing with diminished net investment income growth prospects. And this could have two consequences for the business development company:

- Sixth Street Lending’s net investment income growth would be poised to slow, and;

- The margin of safety, as far as the dividend is concerned, could be diminished.

On the flip side, if the central bank were to keep rates higher even longer, then TSLX might see substantial upside in its net investment income which could then support the premium valuation.

My Conclusion

Sixth Street Lending continued to out-earn its dividend with net investment income in the first quarter and the business development company continues to be focused, both in terms of portfolio mix and new originations, on First Liens.

What I see as a strength presently, but as a weakness in the long-run, is that Sixth Street Lending is playing the central bank’s game and remaining invested in floating-rate loans. If the central bank moves away from its presently highly accommodating position, Sixth Street Lending is dealing with diminished prospects for net investment income growth which might pressure the NAV premium.

Though I am still holding TSLX, exclusively for income, I don’t anticipate much growth of my investment capital, for this specific reason.

Sixth Street Lending is presently selling for a 24% NAV premium which is relatively high compared against the premiums demanded for Goldman Sachs BDC and Golub Capital BDC. Hold.

Read the full article here