Investment thesis

Synaptics (NASDAQ:SYNA) is experiencing severe headwinds due to the challenging environment with weak end markets’ spending. On the other hand, secular trends are favorable for the company and my analysis suggests that it is well-positioned to absorb long-term growth opportunities. I like the management’s commitment to innovation and its long-term mindset. The company sustains profitability even under vast pressure on revenue. I think that the company is strong enough to weather the storm which can last for multiple quarters. The stock is a Buy for long-term investors, who are tolerant of short-term volatility.

Company information

Synaptics is a leading developer and fabless supplier of premium mixed-signal semiconductor solutions. The company’s customers include many of the largest global original equipment manufacturers [OEMs]. End markets include smart home devices, automotive solutions, laptops, smartphones, and tablets.

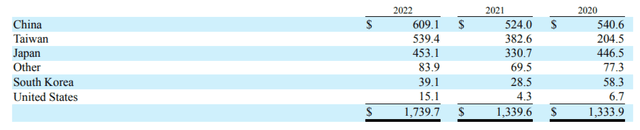

The company’s fiscal year ends on the last Saturday in June. The company disaggregates its sales by end markets and by geographic area. Less than one percent of the total revenue is generated in the U.S.

SYNA’s latest 10-K report

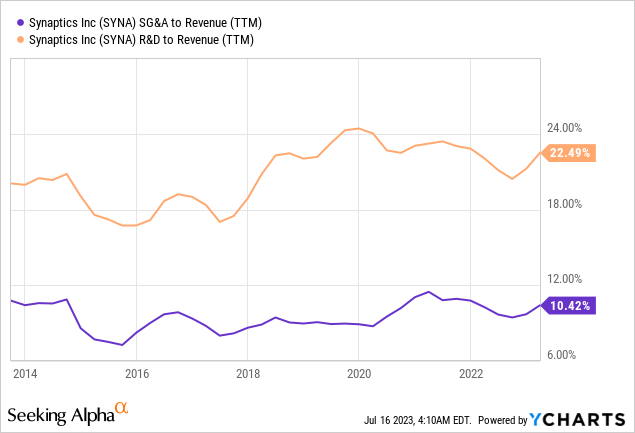

The Internet of Things [IoT] is the leading end market for the company, with sales representing about 63% of the total. This is also the fastest-growing category, with revenue increasing threefold since FY 2020.

SYNA’s latest 10-K report

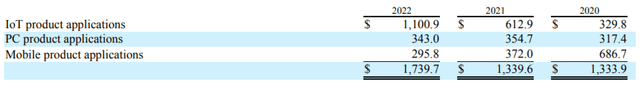

Financials

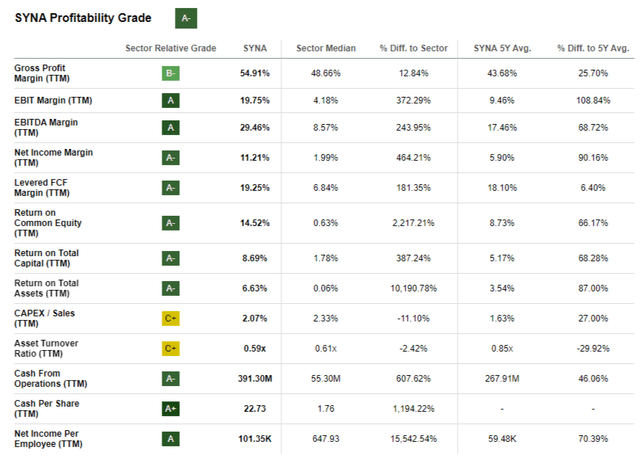

The company’s financial performance was solid over the past decade. Profitability metrics demonstrated significant expansion as the business scaled up. To me, this clearly indicates that the management was efficient in managing growth and had a close eye on expenses. I also like that the company’s free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] has been consistently in double digits over the past three years.

Author’s calculations

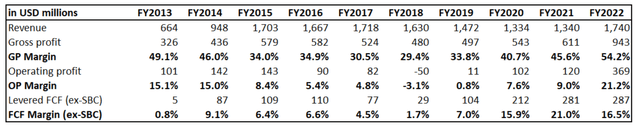

What also grabbed my attention was the management’s commitment to innovation because the revenue reinvested in R&D is substantial and has constantly been above 20% over multiple years. The company has also been very efficient in SG&A spending, which was substantially lower than the R&D spending. For me, it indicates the management’s long-term mindset where they are striving to build long-term drivers for revenue growth and margin expansion.

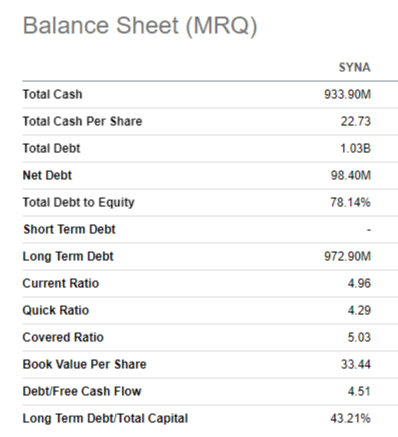

As a growth company, SYNA does not pay dividends. However, it consistently returns money to shareholders via stock buybacks. The company’s capital allocation approach looks conservative, with relatively low leverage and maintaining high liquidity ratios.

Seeking Alpha

The latest quarterly earnings were released on the third of May, with SYNA delivering slightly above-the-consensus top and bottom lines. Revenue and EPS declined YoY considerably due to the challenging economic backdrop. I like that during the earnings call, the management underlined its commitment to strict discipline in cost management and working with elevated inventory levels.

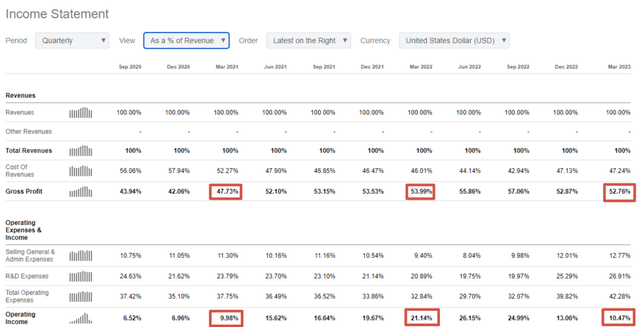

The positive sign to me is that the gross margin did not suffer much, even with a substantial revenue decline. However, the operating margin was more than halved due to the mostly fixed nature of operating expenses. That said, operating expenses did not increase in absolute terms, which is also a good sign to me.

Seeking Alpha

The weakness in momentum is expected to continue in the upcoming reportable quarter. Consensus estimates forecast quarterly revenue at $223 million, more than two times lower YoY. The EPS will also deteriorate significantly. The weakness is explained by the softening demand in the end markets and the challenging macro environment with end customers cutting costs due to high inflation and high-interest rates. But, I think that these headwinds are temporary and not secular because the long-term prospects of the IoT market are bright. Fortune Business Insights forecast the IoT market to grow at a 26% CAGR up to 2030. I have high conviction that SYNA is well-positioned to absorb this favorable secular trend due to the company’s efficiency which is evidenced by its stellar profitability metrics compared to the sector median.

Seeking Alpha

Overall, the weakness in earnings might last for a couple more quarters, but I think that the company’s healthy balance sheet and solid profitability margins will let it weather all the headwinds related to end markets.

Valuation

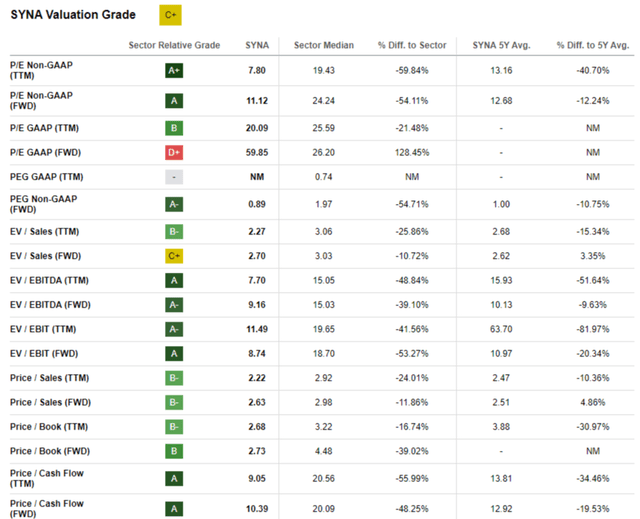

This year, the stock significantly underperformed the broad market with a 3% price decline. Seeking Alpha Quant assigned the stock a decent “C+” valuation grade. Below you can see that apart from the forward GAAP P/E ratio, all other multiples look very attractive. That said, the stock is undervalued, based on valuation ratios peer and historical analysis.

Seeking Alpha

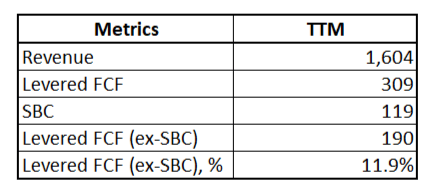

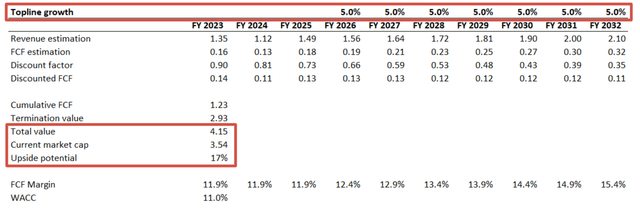

To get more confidence regarding SYNA’s undervaluation, I will proceed with the discounted cash flow [DCF] analysis. Finbox.com suggests using an 11% WACC as a discount rate. I have revenue consensus estimates, which are available up to FY 2025. Under the base case scenario, I use a conservative long-term 5% revenue CAGR for years beyond. For the FCF margin assumption, I use TTM metrics, which I calculate below.

Author’s calculations

I expect the FCF margin to be flat in the upcoming three fiscal years and then expand by 50 basis points yearly. Incorporating all the above conservative assumptions into the DCF template gives me a fair value of the business at $4.15 billion, indicating a 17% upside potential for the stock.

Author’s calculations

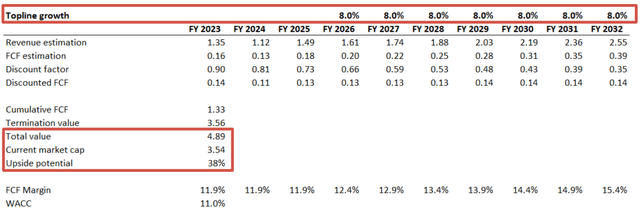

Bulls might argue that the revenue growth assumptions I incorporated are way too conservative. So, let me simulate a more optimistic scenario with an 8% revenue CAGR for the years beyond FY 2025. All other assumptions I will leave unchanged.

Author’s calculations

Under the optimistic revenue growth assumptions, the stock has a 38% upside potential. I think that the optimistic growth profile is doable for the company, especially considering a historical 10% revenue CAGR over the past decade.

Risks to consider

SYNA is a growth company and its stock price fluctuations are very vulnerable to the ability to sustain solid revenue growth. In case the company fails to return to the revenue growth path after the global economy starts its recovery cycle, this might lead to investors’ disappointment and a potential stock sell-off.

The company generates almost no revenue within the U.S. That said, earnings are very vulnerable to risks related to international trade. This includes foreign exchange risks, so the company needs to be efficient in hedging it. Apart from potential unfavorable volatility in the foreign exchange markets, SYNA’s operations are highly dependent on the stability of international trade regulations and tariffs.

Last but not least, as a technology company, there is always the substantial risk of technology obsolescence. In the rapidly evolving technological landscape, it is difficult to forecast the length of business life cycles. I see the company’s efforts to mitigate this risk by constantly investing in R&D.

Bottom line

Overall, I think that SYNA stock is a buy. I think that all near-term headwinds are already priced in, and the current share price provides good buying opportunities. The upside potential looks very attractive even under conservative assumptions. I think that the long-term prospects of the company are bright and it is well-positioned to capture favorable secular tailwinds.

Read the full article here