The Thesis

Following a strong 2023, driven by an improved supply chain and strong customer demand across most of the company’s business in the first half of 2023, Terex Corporation’s (NYSE:TEX) growth moderated as it entered 2024. This was primarily a result of the soft demand environment for the company’s products and solutions in the Europe region. Demand in North America on the other hand remains healthy, which along with strong backlog levels and improved lead time should drive the company’s topline growth in 2024. The company’s focus on product innovation to address evolving customer needs, strategic M&As, and tailwinds from megaprojects funded by government and onshoring activities should drive sales for TEX in the coming years. The margin prospects look good as well, driven by the benefit from anticipated volume growth, cost reduction activities, and strong operational execution. The company’s stock is currently valued at a notable discount to its historical levels. While the company’s growth prospects look favorable, I consider this stock to be undervalued at the moment making it a decent opportunity to buy this stock at the current levels.

Business Overview

Terex Corporation is a global company that is involved in the manufacturing and selling of machinery and services related to lifting and material processing worldwide. The company mainly operates in two segments:

-

Materials Processing (MP): This segment primarily designs, manufactures, services, and markets equipment including crushers, screening, washers, pick and carry cranes, tower cranes, and conveying materials. These products are used in various industries such as mining, recycling, and aggregate processing.

-

Aerial Work Platforms (AWP): The AWP segment of the company involves manufacturing, servicing, and marketing aerial work platform equipment and telehandlers under the Terex and Genie brands. Products in this segment include booms, scissor lifts, and portable lifts that are used in construction, maintenance, utility work, and various infrastructure projects.

Last Quarter Performance

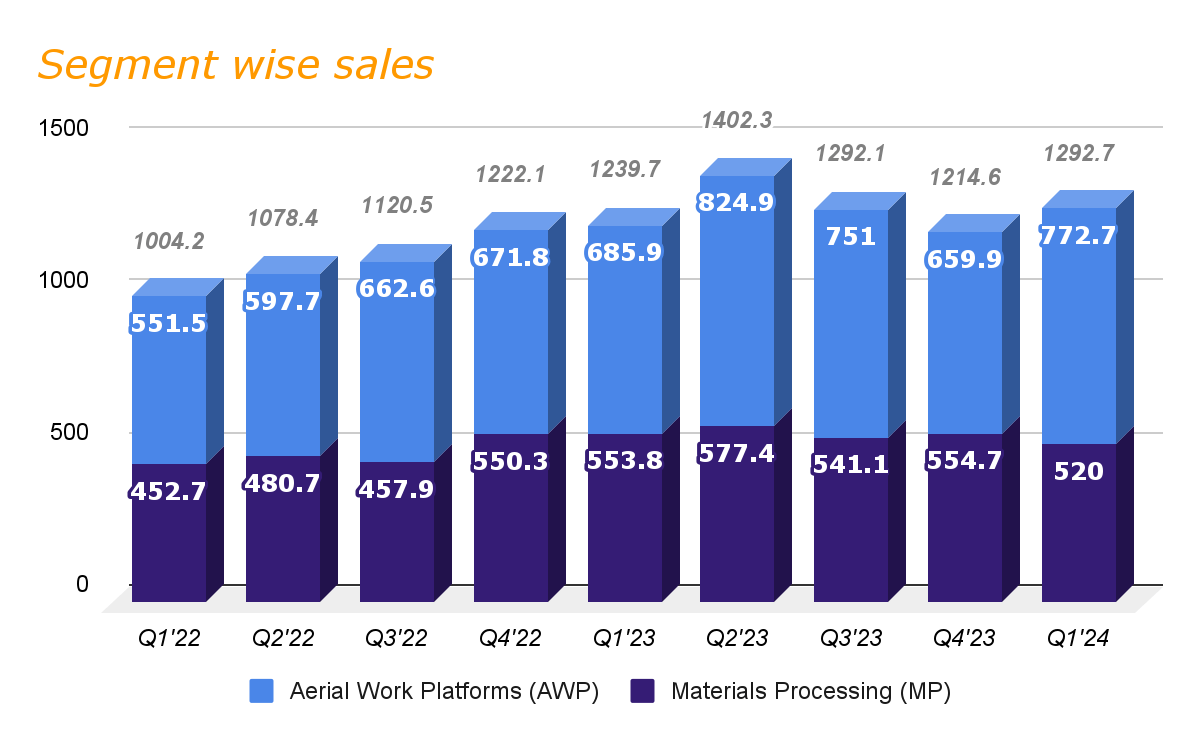

TEX experienced strong double-digit growth in the first few quarters of 2023, however, it moderated in the last quarter due to a softer demand environment in the company’s Europe business. This weakness continued as the company entered 2024, as the company reported low single-digit growth in its topline. The company’s sales were up approximately 5% year on year to $1.3 billion reflecting the impact of continued strong demand in the company’s AWP segment, which grew nearly 13% during the quarter. The MP segment on the other hand saw a decline of 6.1% versus the prior year quarter due to challenging macro primarily in the Europe region.

TEX Segment wise sales (Research Wise)

The company’s margin on the other hand continues to grow steadily as the company’s operating margin expanded 20 bps year on year to 12.2% during the last quarter. This was mainly due to strong margin growth in the AWP segment which climbed about 180 bps during the quarter, thanks to strong operational execution, disciplined cost management, and improved supply chain. The MP segment margin was down to 13.9% from 15.4% a year ago due to the negative impact of volume deleverage and unfavorable product mix during the first quarter of 2024. Increased operating income also benefitted the company’s bottom line performance as it reported its EPS at $1.60, beating the consensus estimates by a notable $0.23 during the quarter.

Outlook

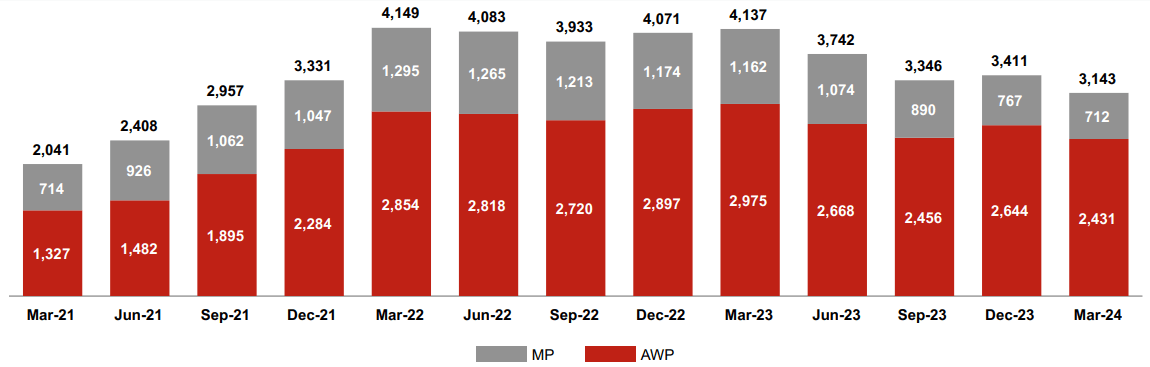

After a strong 2023, the company’s topline growth moderated as the company entered 2024 due to continued softness in demand for the company’s products and services in the Europe region. I expect this to continue further in the near term due to challenging macro conditions for a few of the company’s businesses in the region. However, customer demand across North America, which accounts for approximately 60% of total sales, remains strong due to favorable end-market conditions, which should support the company topline in the quarters ahead. The company’s backlog has moderated notably in recent quarters but is still significantly above historical levels, currently at $3.1 billion as of the first quarter of 2024. In my opinion, this strong backlog should boost the company sales in the coming quarters as lead times and supply chain continue to improve.

Backlog trend (Company presentation)

TEX’s business is also well positioned to benefit from increased U.S. government spending and an increasing number of projects in the longer term, which is to modernize infrastructure over the coming years. Onshoring and mega projects related to clean energy, semiconductor manufacturing, and EV battery projects also continue to drive construction spending in the region, which is up 30% year on year. In the U.S., power-related spending is growing in double digits due to rising investments in grid upgrades and expansion required for zero carbon and amplified electrification needs associated with power generation for AI applications, which should continue to drive the utility market further benefiting the company’s sales in the coming years. Overall, the demand environment across most of the end market including infrastructure, utilities, manufacturing, and recycling looks positive and continues to show strength which should support the company sales in 2024 and beyond.

Apart from these, the company also remains focused on product innovation and continues to develop new products to address its customers’ evolving needs which should help the company gain market share. The company launched a variety of new products across the portfolio during the recent quarter, which also benefited the company as in the past year approximately 20% of sales came from new products introduced. In my opinion, as the company continues to provide innovative solutions to its customers to support development globally, the company’s sales should continue to benefit from it. Additionally, the company also continues to focus on potential opportunities in M&A that are aligned with its objective of broadening market reach and strengthening its portfolio.

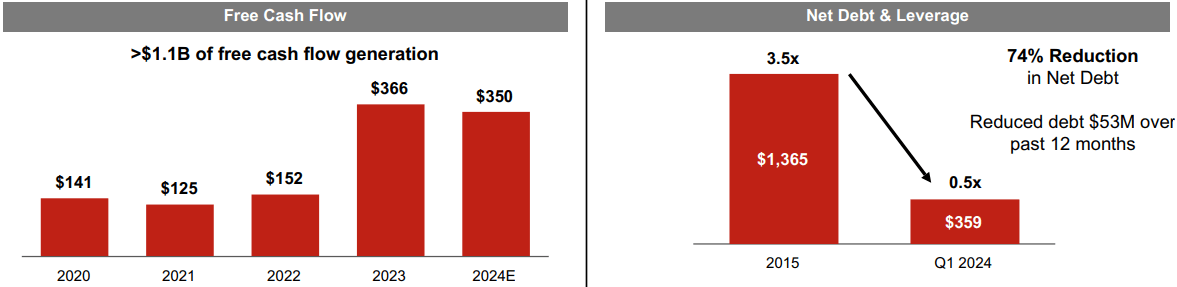

The company is also financially sound with an expected cash flow generation in the range of $325 million to $375 million for FY24, and a net leverage of 0.5, which is well below its target of 2.5 times. In my opinion, this should continue to support the company in debt repayments further improving their net leverage, which should support the company in its future potential inorganic action resulting in topline growth in the coming years.

TEX’s financials (Company presentation)

In summary, while there are some near-term headwinds associated weak demand environment in Europe, demand conditions remain favorable across North America, which along with a strong backlog should drive the company’s sales in the rest of 2024. Benefits from onshoring trends and increased government funding on the other hand should support the company’s topline growth in the coming years.

Valuation

YTD, the company’s stock has given negative returns in high single-digits to its investors as growth moderated in the past few quarters followed by challenging macro conditions in Europe. Currently, the company’s stock is trading at a forward P/E ratio of 7.47, based on its FY24 consensus EPS of $7.16 representing a significant discount to its five-year average P/E of 11.33.

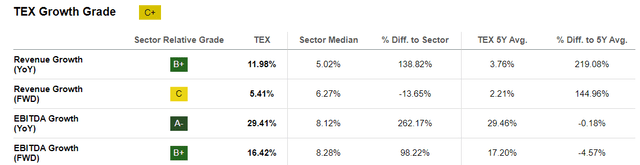

TEX growth grade (Seeking Alpha)

I expect the company’s topline to steadily grow in the coming quarters despite challenging conditions in Europe as the demand environment remains healthy across most of the end market in North America. Backlog levels are also strong further fueling topline growth in the quarter ahead. The benefit from anticipated volume growth, disciplined price cost management, and improved operational efficiency on the other hand should help the company in margin growth. The company is also expecting an incremental margin of 30%, which should further drive the company’s margin growth leading to bottom-line expansion in the coming quarter. As we can see in the table above, while the company’s forward revenue growth appears to be slightly lower versus its sector median, but the EBITDA is expected to continue growing in double digit going forward as compared to single digit sector median growth. Considering these factors and the company’s strong position to continue its growth further, I believe the company’s stock to be attractively valued at the moment and should also improve further with margin expansion in the coming years.

Risk

The company’s topline growth has moderated significantly in the last few quarters due to persistent weakness in the Europe region, which also impacted the company’s margin growth. However, strength across most of the end markets in North America supported the company’s overall profitability leading to a steady growth in the company’s margin. My thesis is built upon the expectation that the company will experience volume growth in 2024 which along with the benefit from cost-reduction activities and strong operational execution should result in increased profitability leading to bottom-line expansion in the coming quarters making the valuation ever more reasonable. However, if the weakness in the European region continues or worsens, the company’s bottom line might be impacted negatively leading to deteriorated valuation and potentially leading to poor stock performance in the future.

Conclusion

As we discussed earlier, the company’s stock is trading at an attractive discount to its historical average. The company’s revenue should benefit from healthy demand across America and strong backlog levels more than offsetting the negative impact of ongoing softness in the Europe region. The long term also looks good due to tailwinds from government funding and onshoring activities. Margin should also benefit from volume growth and disciplined price cost management in the coming quarters. Considering these factors, I believe, the stock is at an attractive valuation at current levels. Hence, I would recommend to “BUY” this stock.

Read the full article here