Under Armour (NYSE:UA) (NYSE:UAA) is a global sports and performance apparel brand.

The company’s successful growth story began in the late 1990s and continued until about 2017. It focused on athletic performance apparel and shoes. A series of bad decisions since have curtailed margins and growth and led to impairments and managerial change.

Last month, Under Armour announced that its founder, controlling shareholder, and CEO from 1996 until 2019 would return as CEO. He is the fifth CEO in five years.

Some investors are excited about the founder turning the company around. I believe the evidence does not support that. The current CEO served until 2019, and the company started showing problems in 2015. Controlling 80% of the votes, he had a big say in who was CEO and what the strategy was. The failures of the previous plans are also his failures.

In terms of valuation, I think the stock is priced for a very neutral scenario, trading at an EV/EBIT multiple of 12x for FY25E EBIT (excluding restructuring impacts). I have a bearish bias on the new plan because the founder/CEO also participated in previous failed plans, but a bullish reader might consider the stock an opportunity. Beware of a very bad read in 1Q25, though, as the company guided for $80 million in operating losses for the quarter.

Company intro

Sports performance core: Under Armour is one of the leaders in sports performance apparel. The company pioneered the use of synthetic fibers in apparel, which was previously made of cotton. Today, this is the industry standard. The company’s products were always marketed for athletes, not regular people who exercise. UA’s sports marketing concentrates on American football and running.

Apparel, wholesale, US mix: The above led to Under Armour’s mix being more oriented towards apparel (65% of revenues), compared to others like Nike, which are more skewed towards footwear (2/3 of Nike’s revenues). UA is also more dependent on wholesale sales (60% of revenues) and the US (65% of revenues).

Low leverage: The company boasts only about $600 million in very convenient debt (3.25% fixed rate maturing 2026), plus a $1.1 billion working capital facility drawn and repaid during the year. In contrast, UA holds about $1 billion in cash. The company is, therefore, not financially leveraged.

Strong founder/shareholder/CEO: The company’s founder, Kevin Plank, was its CEO from 1996 to 2019, after which he became Chairman. As of the latest proxy, he controlled 24% of the stock and about 80% of the votes, thanks to a special founder class of shares. Plank recently returned as CEO of the company, a change announced in April 2024.

Challenges

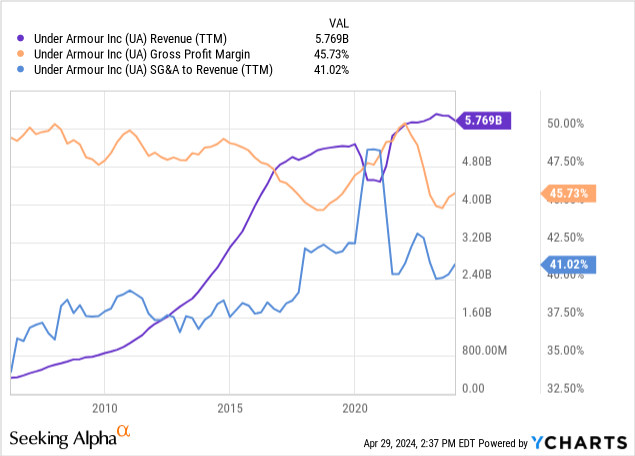

Focusing on serving the more core athlete markets, UA did very well since its founding and until about 2017, boasting very high growth rates (almost quintupling revenue from 2010 until 2017). This was coupled with 10%+ operating margins.

However, things started going south in 2016 and have not recovered since. Below, I list some of the problems the company faced.

Dependence on promotions and discounts: The company pushed the movement to more massive markets by relying on discounts and general merchandise retailers that diluted the brand. It also has more than 175 factory stores for off-price inventory clearance, compared with less than 20 flagships, full-price retailing stores (as reported on their 10-K). This led to the decrease in gross margins seen above, only temporarily reversed during the stimulus years of 2021/22.

Too much overhead: At the regional segment level, Under Armour’s regions have 15/20% margins. Corporate represents close to 13% of revenues, a large number.

Constant restructuring: Since 2017, Under Armour has been through several restructuring programs. In 2017/18, they led to more than $300 million in restructuring charges and impairments, followed by another $600 million in 2020. As a sample of the bad investment decisions of the company, in 2020, it had to impair $290 million from a single flagship store in New York.

Bad acquisitions: In 2015 and 2016, the company purchased several fitness apps for runners and nutrition for what can be considered high valuations. The company spent more than $600 million on three apps, a segment that would be sold at impaired valuations several years later.

New year, new restructuring

Five years, five CEOs: As mentioned, the company’s founder returned as CEO in April 2024, after leaving the seat to become Chairman in 2019. He returns as CEO as the fifth in five years, including himself as interim between 2021 and 2022.

Wholesale collapse triggered the restructuring: I believe his return was triggered by very bad wholesale reads for FY25 (ended March 2025). The company expects North America revenue to fall low double digits for FY25, after falling 10% in FY24. In my opinion, if wholesalers are dumping the product so much, it is because the product is unwanted in the stores. Under Armour is in a bad position. A change in management makes the company look more active and offensive in what is a very bad situation.

The new plan: The founder laid out his restructuring plan in the 4Q24 call. The new plan has four core tenets: reduce promotionality, elevate the brand, focus on core sports and men, and reduce SKU complexity.

Intuitively, the strategy makes sense to me. I prefer brands that compete on product and not price, and Under Armour’s history is rooted in being the sports brand for real athletes. Reducing product and category complexity can help reduce corporate overhead.

What about the old plan?: A founder CEO going back to the roots sounds exciting. However, I also wonder why the same founder, as Chairman, approved the previous plan only twelve months ago. The plan presented in the 4Q23 call prioritized footwear, stylish sportswear, and women’s categories. The 4Q24 plan says that all of that is subsidiary, with the new focus being men athletes. The strategy is contradictory.

As Chairman, he also signed on plans from the 2019/2021 CEO, but that didn’t work either and is now being rejected for the second time. I believe the founder’s failure as Chairman is evidence against optimism about his execution as CEO.

Valuation

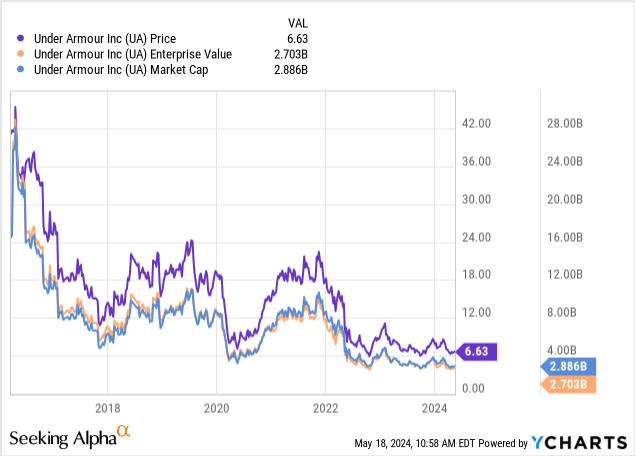

Under Armour’s valuation is not very demanding on an EV/EBIT (ex-restructuring) basis. Based on the company’s guidance for FY25 (ended March 2025), it will generate $140 million in operating income, or $220 million, before restructuring charges of $80 million ($40 million cash). With a current EV of $2.7 billion, it trades at a 12x multiple of pre-restructuring operating profits.

If things work well, pre-restructuring operating profits could be a proxy for the initial profitability after the restructuring. The company trades at a ‘survives the restructuring’ price, making it a relatively conservative or neutral read.

On the one hand, we have the possibility that Under Armour’s restructuring works out, and the company will grow from those $220 million in FY26 and FY27. In that case, the EV of $2.7 billion is cheap today. However, the new plan might be as bad as the old plans, and Under Armour might continue to do badly. In that case, $2.7 billion is expensive.

I am inclined more toward the bearish than the bullish side of this read, and therefore, I do not think Under Armour is a true opportunity at these prices. However, it is clearly not overvalued either, and more bullish readers could consider it a good speculation.

I also believe that there might be an opportunity to buy stock at better prices in 1Q25 (announced August 2024). Management guided for an operating loss of $80 million in the quarter, which could affect sentiment negatively.

Read the full article here