I wrote about Village Farms (NASDAQ:VFF) at the end of April, explaining why I no longer included it in my model portfolio that I share with members of my investing group. Now, I hold a 15% position despite it not being a member of the index that I aim to beat. The company reported its Q1 in May, and today I discuss the financial results, the outlook, the chart and the valuation of the stock.

Village Farms Is Off to a Good Start in 2024

Analysts had expected total revenue to be $72 million in Q1, with adjusted EBITDA of $2 million. Revenue was much higher than expected at $78.1 million, up 21%. Adjusted EBITDA also came in ahead of expectations, rising from $0.5 million to $3.6 million.

The Canadian cannabis business enjoyed booming growth, with revenue of $37.4 million rising 49%. Adjusted EBITDA of $4.1 million improved from $3.9 million a year earlier. Gross margin fell as the company boosted non-branded sales, which reduced inventory.

I am not a big fan of either of the other two operating businesses, U.S. cannabis, which is CBD, and produce. The U.S. cannabis business, Balanced Health Botanicals, was acquired three years ago for $75 million and has been disappointing. Revenue fell by 10% to $4.5 million, and the company had an adjusted EBITDA of -$0.6 million. The produce business grew 4% to $36.1 million. Adjusted EBITDA went from -$1.0 million in that unit to $2.0 million.

Looking again at the overall company’s financials, inventory fell during the quarter to $74 million. Cannabis inventory fell sharply, while produce inventory increased. Cash flow from operations improved substantially from Q1 of 2023, though it was not particularly high at -$50K. Property, plant and equipment purchases increased to $1.9 million, so the company had negative free cash flow. Cash flow has been improving a lot. It was -$39.6 million in 2021, -$19.9 million in 2022 and +$5.3 million in 2023.

The balance sheet had a current ratio of 2.1X, which is adequate. Net debt ended the quarter at $23.4 million, which is small relative to the tangible book value of the company at $210.5 million as well as the level of revenue. The debt is due mainly in 2026 and 2027.

The Outlook for Village Farms Remains Solid

Ahead of the Q1 report, five analysts were looking for 2024 revenue to be $308 million, with adjusted EBITDA of $12 million. For 2025, two analysts were expecting revenue to be $335 million, with adjusted EBITDA of $19 million. Now, according to AlphaSense, the outlook is for 2024 revenue to be $308 million. The consensus for 2025 is that revenue will increase again to $339 million.

Previously, I was using Sentieo, but it was acquired by AlphaSense, which doesn’t have adjusted EBITDA estimates for Village Farms currently. The company had positive adjusted EBITDA in 2023 after a large loss in 2022 of $34.6 million. The $7.6 million in 2023 was less than the 2021 level of $14.0 million. AlphaSense has a forecast for positive income from operations in 2025, which would be a first for the company and would suggest adjusted EBITDA of more than $19 million. Roth MKM analyst Scott Fortune revised his 2024 projection from $11.7 million to $15.4 million and shared a 2025 outlook for $20.6 million based on his revenue projection of $316.4 million. I think that his margin is probably correct, near 6.5%. I am using 6% on the revenue projection at AlphaSense to get $20.3 million.

Village Farms Chart Looks Decent

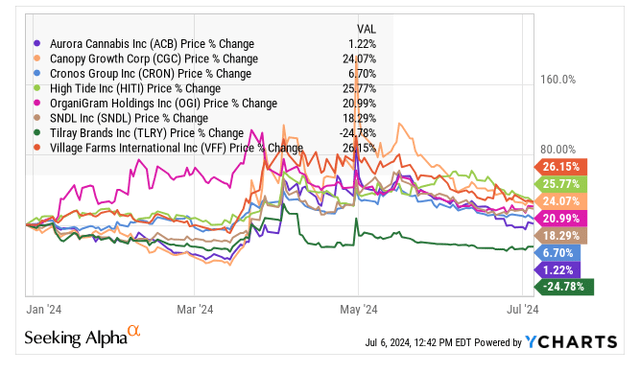

In my late-April piece ahead of the Q1 report, the stock was $1.355. It was up 78% year-to-date then. Now it is up 26.1% after falling to the current price of $0.96. The overall market, as measured by the New Cannabis Ventures Global Cannabis Stock Index, has gained only 3.8% so far in 2024, so VFF is a strong performer despite the big pullback.

Comparing Village Farms to the main peers, it’s in first place for the year-to-date:

YCharts

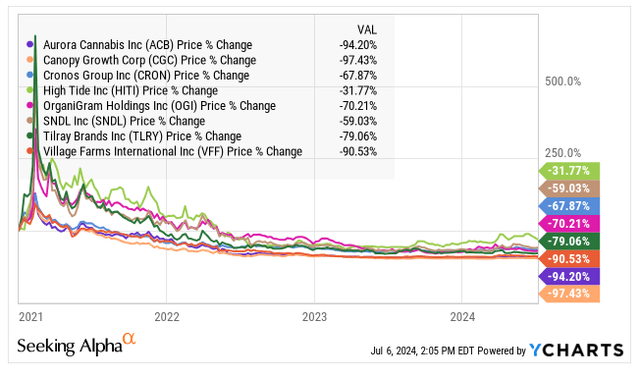

Taking a look since the end of 2020, it is not in first place! The 90% decline is less than Canopy Growth’s 97% drop and the 94% fall that Aurora Cannabis has suffered. It’s worse than Cronos Group and Organigram:

YCharts

Taking a look at the Village Farms chart over the past two years, the stock bottomed last August near $0.55:

Schwab

In early 2023, the company sold units and surprised the market with the financing, and the stock gapped down. It took more than a year to fill that gap, but it did so in March.

Village Farms is listed only on the NASDAQ, and that listing could become vulnerable to being eliminated if the stock trades below $1 for an extended period of time. Companies can reverse-split, if necessary, to maintain a listing, but that’s not always possible. Several cannabis companies have moved from the NASDAQ to the OTC.

As I discuss below, the valuation of Village Farms is so low that I don’t think it should trade lower, but it might. I currently see $0.80 as support. The stock ended 2023 just below that level at $0.761. I am concerned still about Canopy Growth (CGC) and Tilray (TLRY), as both of these stocks could fall a lot and impact how investors feel about VFF. As a reminder, the exercise of the $1.65 warrants could impact the price of the stock. Ahead of that, I see resistance at $1.15-1.20 and then higher as well. Beyond $1.65, the chart shows resistance near $2.

The liquidity of VFF is not as good as some of its peers. Over the last month, it has averaged about 415K shares per day, leaving it disqualified from joining the Global Cannabis Stock Index, which requires at least $500K of trading value per day. The company does not have a strategic investor like Canopy Growth (Constellation Brands), Cronos Group (Altria) or Organigram (British Tobacco).

Village Farms Is Very Attractively Valued

Village Farms seems very cheaply priced to me. The stock trades at half its tangible book value, which is way too low. I have a larger position in the model portfolio in Organigram (OGI), and I just put in a small position in Cronos Group (CRON). Organigram trades at 83% of tangible book value, and Cronos Group trades at 86%. Both companies are cannabis pure-plays and have big outside investors, and both have no debt and a lot of cash. O.5X is low, but VFF traded at 0.36X ahead of the Q4 report!

Of course, most investors are not using price to tangible book value as a primary metric for valuation. Instead, they look at cash flow and the enterprise value to adjusted EBITDA. Using the $20.3 million estimate for 2025 that I discussed above, Village Farms trades at 6.5X. Ahead of the Q1 report, I suggested to members of my investing group that my year-end target was 100% of tangible book value, which worked out to $1.85 at the time. This was higher than the $1.70 that I shared in that April article that was based on 90% of tangible book value. My current view is that it could get to tangible book value at year-end, and this works out now to be $1.85 still (assuming the $1.65 warrants are exercised). This would be just 10X adjusted EBITDA.

Conclusion

I think that Village Farms has a great Canadian cannabis business that has tremendous opportunities in legal markets in other countries, like Israel, Germany and the Netherlands. The company commenced operations in the UK in December and plans to launch operations in additional European countries this year.

I wish that cannabis was all that Village Farms does, as my analysis would be easier. I am not a fan of either of the two other businesses, but they aren’t worth less than zero in my view. The Canadian cannabis business in 2023 generated $14.8 million in adjusted EBITDA, and this will likely be higher ahead. If just that were valued at 10X adjusted EBITDA for its Canadian cannabis operations, it would trade right now at higher than the current price. The company isn’t likely to get out of the produce business or the CBD business, but it is doing a better job. Hopefully, the adjusted EBITDA continues to improve and investors start paying attention.

The Canadian cannabis market is rather mature, which could weigh on its growth. In April, cannabis sales in Canada grew just 4.4%, which was the second-lowest month after the 0.1% growth in March. One improvement would be if the country were to change its taxation, which is based on a fixed tax per unit sold rather than a percentage of revenue. In 2023, the company paid excise taxes of $58 million, which was 39% of branded cannabis sales. This is very high and was up from 37% in 2022. Another thing that could help would be more exits of licensed producers. There are currently 986 licenses, but this includes many that are suspended, pending revocation or expired. There have been several bankruptcies and auctions.

I have liked Village Farms for a while now, but I stepped aside in April. Now, it is a large part of my model portfolio. Cannabis investors are getting another opportunity to enter. My year-end target is almost double the current trading price.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here